Apple is winning the tablet battles that matter, even in the workplace, new research says.

10 Best Tablets Of 2013

10 Best Tablets Of 2013 (Click image for larger view.)

Apple's iPads remain the most-used tablet line, both generally and in the workplace, according to two reports released Wednesday.

The mobility management vendor Good Technology said iPads accounted for 91.45% of its customers' tablet activations in the fourth quarter of 2013. If smartphones are included, Apple's slates represented 19% of all mobile devices deployed during the quarter.

Good said iPhones and iPads represented 73% of device activations in the quarter. More than half of all devices deployed were iPhones, and Apple products were the 10 most popular devices tracked in the report.

[Apple revolutionized smartphones and tablets. Could TVs be next? Read Apple TV Refresh: 9 Wishes.]

Android tablets and smartphones combined represent only 26% of device activations in Good's data set. This indicates not only that enterprise iPad adoption trounced corporate uptake of Android tablets, but that iPads alone accounted for nearly as many device activations as all Android devices of all form factors, smartphones included.

Meanwhile, online ad tracker Chitika reported that between January 20 and February 4, iPads generated more Web traffic than any other devices in its network. Chitika's report states that North American tablet traffic peaks each day around 9:00 PM EST and that iPads account for four times more Web activity than Android devices during this period.

Each report is limited in certain ways. Good drew data only from customers that activated at least five devices over the quarter, meaning the statistics represents an unknown subset of the more than 5,000 organizations using the company's products.

Moreover, while Good services a small number of Windows Phone customers, its products do not yet support Windows 8 or 8.1 tablets. Other indicators suggest Windows slates have failed to make a dent on the overall market, however, so it's unlikely that Good's Windows omission led to a substantial overestimation of iPad share. In fact, Good's data indirectly supports the notion that Windows tablets haven't disrupted the market: It found that mobile device activations grew 34% in 2013, which, given the iOS and Android-heavy nature of the company's data pool, suggests Windows tablets haven't slowed the progress of competing platforms.

Chitika derives data from a large sample of 300 million ad impressions spread across 300,000 websites. But while Good's statistics come from devices in up to 130 countries, Chitika looks only at tablets in the US and Canada. It additionally records data based on Web usage, not individual users.

Like the Good report, Chitika's data offers limited insight into Windows tablets. The company can differentiate ARM-based Windows devices such as the Surface or Surface 2 from other tablets, but it cannot distinguish x86-based slates such as the Surface Pro from Windows desktops. Consequently, only ARM-based Windows devices factor into Chitika's report.

Nevertheless, both reports offer intriguing observations. Chitika found that iPads obliterated ARM-based Windows tablets overall, but it also noted that Surface and Surface 2 users are most active during the workday, suggesting Microsoft has made very modest progress positioning its tablets as productivity-oriented devices.

Good's data provides some context for overall market share statistics, which generally tend to favor Android. Research firm IDC announced in late January, for example, that iPads accounted for 33.8% of Q4 tablet shipments. That mark was good enough to make Apple the top tablet vendor, with a nearly 80% lead over second-place Samsung, but it might still seem incongruous with Good's account, which describes a near-monopoly for iPads in the enterprise.

IDC's figures don't suggest that Good's results are skewed -- rather, Good's data contextualizes the iPad's actual standing in the market. Apple's defenders frequently point out that iPad users are likely to purchase apps, accessories, and additional iOS and OS X products. Android, in contrast, gains much of its market share via cheap "white box" devices that rarely encourage platform loyalty. The argument is that Android might be gaining market share, but iOS continues to win the battles that really matter -- such as high adoption rates among affluent consumers, popularity in the enterprise, and an ecosystem that effectively encourages both app purchases and device upgrades.

Apple CEO Tim Cook referenced this concept in a recent interview with The Wall Street Journal. "I look at the mobile phone market as having three kinds of phones: feature phones, smartphones that function as or are used as feature phones, and real smartphones," Cook said. "I care about the market share of the last one. I don't care how many feature phones are sold. The more that are sold I look at as good because those are all potential future customers for real smartphones. The same thing goes for the second category. I'd like to convert as many of those as possible to real smartphones."

While Cook was explicitly talking about the iPhone, Apple has approached the iPad in much the same way. The company has no interest in competing with budget devices for market share -- not as long as it continues to dominate the most lucrative market segments.

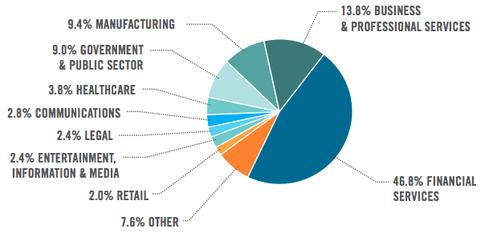

Good's numbers also revealed how businesses are using iPads. Tablets have become popular in a variety of industries, including aviation, retail, and manufacturing, but Good found almost 47% of tracked Q4 iPad activations were in financial services. Business and professional services was a distant second (13.8%), followed by manufacturing (9%), governments and the public sector (9%), and healthcare (3.8%).

Good also reported that enterprises have continued to accelerate the deployment of mobile apps. Companies in the data set most commonly ran document-editing and file access tools on their tablets, though Good noted that custom applications and business intelligence products are becoming more popular.

Engage with Oracle president Mark Hurd, Box founder Aaron Levie, UPMC CIO Dan Drawbaugh, GE Power CIO Jim Fowler, former Netflix cloud architect Adrian Cockcroft, and other leaders of the Digital Business movement at the InformationWeek Conference and Elite 100 Awards Ceremony, to be held in conjunction with Interop in Las Vegas, March 31 to April 1, 2014. See the full agenda here.

About the Author(s)

You May Also Like