Splunk marks another big year, taking in more revenue than the top three Hadoop distributors combined. That's why startups want to follow in its footsteps.

What big data vendor hauls in more revenue than Cloudera, Hortonworks, and MapR combined? It's Splunk, which last week reported yet another year of fast growth, reaching $450.9 million in revenue in its fiscal 2015 year ended January 31, a 49% increase over prior-year results.

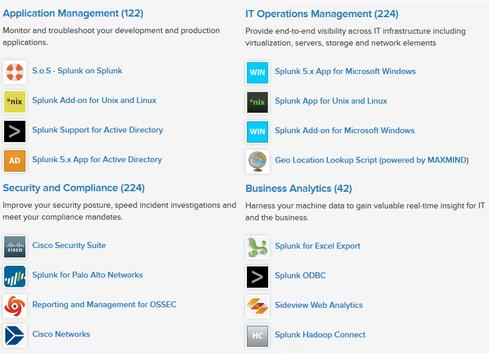

Despite recent talk about the big data market being dominated by open-source technologies, Splunk has managed to grow aggressively with purely commercial technology. Its Splunk Enterprise software, which includes a proprietary big-data repository and analysis software, has long been popular with IT types. The company now claims more than 9,000 customers among enterprises, government agencies, universities, and service providers.

[ Want more on this topic? Read Big Data Tempest In A Teapot. ]

Designed first and foremost for log files and other machine data, Splunk's software is used for IT system optimization, risk analysis, fraud and threat detection, and, to a lesser extent, business-trend analysis. The 12-year-old company has been at the big data game far longer than Hadoop vendors Cloudera (founded in 2008), MapR (founded in 2009), or Hortonworks (spun out of Yahoo in 2011). That's one reason it's far larger. Privately held Cloudera and MapR are pegged at somewhere above $100 million and somewhere below $50 million in annual revenue, respectively. Hortonworks, which raised $100 million in an IPO in December 2014, recently reported $46 million in revenue for fiscal year 2014.

Following its monster, $229 million IPO -- one of the most successful in 2012 -- Splunk introduced Splunk Cloud, Splunk Hunk software that works in conjunction with Hadoop, and Splunk Mint software aimed at mobile developers. Splunk has also extended its software to work with NoSQL databases, including Cassandra, MongoDB, and Neo4j. And to make its software more accessible, Splunk has introduced apps for AWS, Salesforce, and mobile security.

All these efforts to make big data analysis easy and accessible have helped fuel growth. But, like many big data companies, Splunk is not yet profitable. Splunk reported an operating loss of $57.1 million on revenue of $147 million in its most-recent quarter. For fiscal year 2016 Splunk is forecasting a 2% to 3% operating margin on projected annual revenue of $600 million. While most big data vendors are still scratching for their first $100 million in revenue, Splunk is a dollar among dimes in the big data market.

The company is also an outlier in other respects. In fact, "it shouldn't exist," wrote market watcher Matt Asay in a widely read column last year. "Open source owns Big Data, from Hadoop to NoSQL databases," Asay wrote. "How is it that a proprietary, expensive licensed software business can thrive?"

The answer lies in the fact that Splunk's software "just works … with minimal fuss," he wrote. Splunk's SPL (Search Processing Language) for data exploration is relatively simple for IT types, supporting searching, filtering, modification, and manipulation. Splunk also offers drag-and-drop data visualizations and filters for nontechnical business users.

Given its aptitude for analyzing machine data, Splunk is in a sweet spot for Internet-of-Things-style applications. Rumor has it the vendor is gearing up for another new-product announcement, so perhaps IoT will be the latest spin keeping Splunk on the tip of IT tongues?

It hasn't hurt Splunk's brand recognition that various big data startups are calling themselves "the next Splunk." From Sumo Logic to Logentries to (open source) Graylog, they're all gunning to become the next kingpin of big data, but their role model is Splunk, not Cloudera or MongoDB.

Attend Interop Las Vegas, the leading independent technology conference and expo series designed to inspire, inform, and connect the world's IT community. In 2015, look for all new programs, networking opportunities, and classes that will help you set your organization’s IT action plan. It happens April 27 to May 1. Register with Discount Code MPOIWK for $200 off Total Access & Conference Passes.

About the Author(s)

You May Also Like