If federal agencies lose some authority to enforce environmental protection measures, will corporate reporting on sustainability fall by the wayside?

In its recent decision on West Virginia v. Environmental Protection Agency (EPA), the U.S. Supreme Court ruled that the EPA did not have the power to regulate emissions from existing power plants via generation shifting requirements. This raised questions on the EPA’s ability to regulate emissions in the future, as well as the power of federal agencies to regulate such things as tech regulations on data privacy and net neutrality.

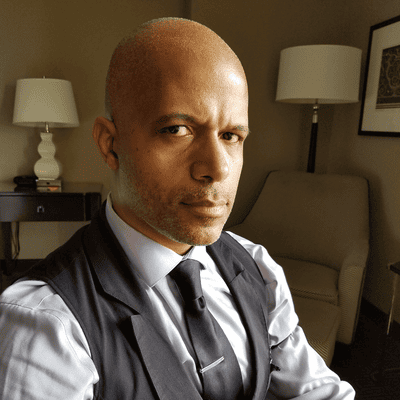

What that means for the environmental, social, and governance (ESG) movement might not be drastic, but it does stir talk about compliance with standards that are optional. “As it stands right now in the United States, ESG disclosures are voluntary by companies,” says Jonathan D. Brightbill, partner and chair of the environmental litigation and enforcement practice for law firm Winston & Strawn. At the point a company starts to make ESG disclosures, he says, it assumes a duty by speaking to ensure the material information conveyed is accurate and not misleading.

Sustainability & ESG Today

ESG strategies vary across organizations. This might include reducing or eliminating data centers to cut back on energy usage, shifting production to more sustainable materials, and capturing data on the company’s ESG efforts. For instance, commercial property owner SL Green Realty announced in June it was using analytics and automation from Envizi to streamline management of sustainability data from its real estate portfolio to simplify ESG reporting.

Brightbill, as Acting Assistant Attorney General at the U.S. Department of Justice under the Trump Administration, argued the case before the U.S. Court of Appeals for the District of Columbia Circuit that would go on to become West Virginia v. EPA. “When the Biden administration came in, they switched sides on the case,” he says. With the stance of the EPA changing along the way, ultimately the Supreme Court ruled in favor of the position Brightbill had originally argued before the D.C. Circuit.

“I don’t think the Supreme Court decision is going to have a material impact on ESG on the voluntary business side,” he says. Stakeholder issues are becoming an increasing part of what managers of investors are worrying about, Brightbill says, as they look to create long-term value for the enterprises they are engaged with.

Investment Decisions, Risk Management

ESG is a tool for investors to make better investment decisions regarding environmental and social issues, says Danielle Barrs, director of ESG and sustainability solutions with Eisner Advisory Group. She also called it a risk management tool. “This is slightly different than sustainability, which focuses on a company’s impact on the environment,” Barrs says. ESG focuses on risks and opportunities that regulations may have on the business in relation to climate change, she says.

Even with a shift in power away from the EPA on certain climate-related issues, Barrs says it is still a good business practice to maintain key “green” policies and to track and report ESG key performance indicators for investment management.

As far as establishing standards in ESG, she says the framework many companies look at currently is the Taskforce on Climate-Related Financial Disclosures, which the Security and Exchange Commission (SEC) announced it would follow. “Much of this follows what Europe has already done,” Barrs says.

The Supreme Court’s decision will have effects on the EPA and other agency’s ability to adopt regulations on greenhouse gas emissions in the context of certain sources, Brightbill says. He also sees the decision being relevant to other courts that review the SEC’s climate-related financial disclosure rules if they are finalized in substantially the same form that they were proposed in back in March. Such rules, Brightbill says, would be a significant expansion of the SEC’s financial disclosure and reporting regimes, which could impose costs on regulated entities.

He says questions remain about whether the SEC has established that climate-related financial disclosures help investors at a macro level. “Those issues are likely to be presented to reviewing courts,” Brightbill says, “who are going to look to the Supreme Court’s major questions doctrine from the West Virginia v. EPA case to say, ‘Hey, is this something that the SEC has done historically and how close an analog is this program to what the SEC has done and required historically?’”

What to Read Next:

How Digital Twins & Data Analytics Power Sustainability

What IT Leaders Should Do Now to Prepare for ESG Standards

CIOs Take Center Stage on ESG Strategies, Battling an Overflow of Data

About the Author(s)

You May Also Like