Demo day hosted by FinTech Sandbox revisited the need for greater diversity among financial industry leaders and the focus of regulators on transparency.

On Thursday morning, a batch of startups in a virtual demo day hosted by FinTech Sandbox talked up ways they might address financial gaps that incumbents in the market have not yet tackled. This was one of the events held as part of New York Fintech Week and included some perspectives from the public sector on financial inclusion.

“Since 2014, we’ve worked with over 260 startups and built a global, collaborative fintech community,” said Kelly Fryer, executive director with FinTech Sandbox, a nonprofit that offers financial data feeds and APIs for development purposes to fintech startups. She led the session with a discussion with Adrienne Harris, superintendent of the New York State Department of Financial Services.

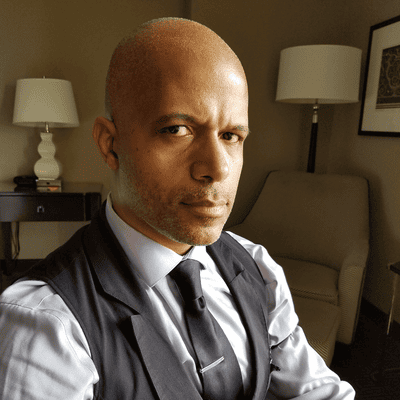

As a financial regulator whose territory includes traditional banks, insurers, and virtual currency companies, Harris said her office holds a vast remit in this space. “My goal for the department is to build an equitable, transparent, and resilient financial system that benefits individuals and supports businesses,” she said.

Harris, who was sworn in in January, said there is a need to increase representation of diverse individuals in the financial industry. “The industry really does need to mirror the diversity of the world that it’s intended to serve,” she said. “With that increased representation in industry, we need to do a better job driving inclusion through new, innovative, safe, transparent, affordable financial products. This is the promise of fintech.”

The responsibility of a regulator

From the perspective of a regulator, Harris said it is her office’s role to ensure such products meet those expectations of safety, affordability, and transparency for the customer. “As regulators, it’s really important that we’re focused on how policies, how our regulations impact everyday people,” she said. “That means reexamining the status quo . . . and kicking the tires on everything we do to make sure that we are beginning and ending with New Yorkers in mind.”

The Department of Financial Services is collecting industry data on diversity, Harris said, beyond the CEOs of financial companies to also look at senior leadership, on the boards, and doing product development within such regulated institutions. “So far when we look at C-suites, they’re not terribly diverse,” she said. “Most of the diversity is represented in the chief diversity officer slot.”

Harris said there is a need for diversity among leadership who have profit and loss responsibility because those are the leaders who develop products and think about the organization’s bottom line. “That’s something we’re pushing our regulated institutions to do,” she said.

Though there has been hype and buzz about financial inclusion via fintech, Harris said there is still a lot of work to do on this front. “Solving access issues is hard,” she said. “There’s lots of complex challenges. We think about the digital divide, digital literacy, making sure these innovations are affordable and transparent.” To that end, Harris said she wants to see that such developments are made with underserved communities in mind and “that we are protecting them while also making sure they can participate in the gains that these innovations have to offer.”

8 Fintech Startups

Before the eight startups got down to the demos, Fryer talked up her organization’s intent to support a more inclusive and sustainable financial future for others. That includes making resources accessible and digital, giving people real-time and around the clock access to the things they need for day-to-day living and working. “We all especially saw this challenge over the past two years with the pandemic,” she said. That topic led off the demos; the presenting startups are listed below:

Rentdrop -- Digital rent payments, eliminating checks and allowing for direct deposits to landlords

Physis Investment -- Platform for tracking and understanding the impact of sustainable investing

Vero Technologies -- Commercial lending platform to help banks better serve the SMB market

Zengines -- Data integration through automation to accelerate system migrations

Paperstack -- E-commerce financing to help online merchants by offering capital to purchase inventory, for advertising, and hiring talent

PunchPay -- SMB lending that can turn expenses into microloans

Unum ID -- Digital identification card app that lets users authenticate their identity without a password and share their data with merchants and other companies

Merkle Science -- A predictive crypto risk and intelligence platform for threat detection, risk management, and compliance

What to Read Next:

NY Fintech Week: Crypto Regulation, Fraud, and Venture Capital

Global Tech Policy Briefing: March 2022

US Regulators Move to Understand Crypto and Explore Guardrails

Read more about:

Technology StartupsAbout the Author(s)

You May Also Like