Consumers love big-screened phones, and these phablets will help drive smartphone growth over the next few years. Apple's iPhone and Google's Android will continue to dominate despite some slowdown in sales.

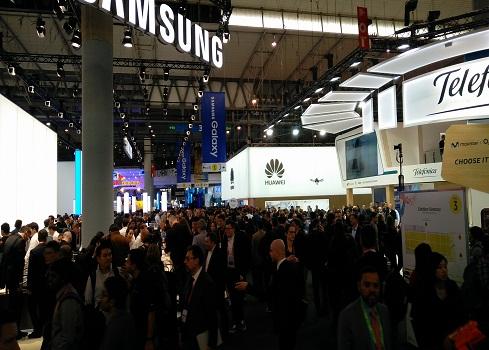

MWC 2016 Best In Show: Galaxy S7, LG's G5, More

MWC 2016 Best In Show: Galaxy S7, LG's G5, More (Click image for larger view and slideshow.)

One in five handsets shipped during 2015 was a phablet, according to IDC, and that number is going to climb to about one in three handsets by 2020. In a March 3 report, the analyst group believes Android and iPhone lovers alike will continue to adopt larger phones even as growth across the industry slows to a crawl.

Phone makers shipped a total of 1.44 billion smartphones during 2015. That number is up a healthy 10.4% compared to 2014, but the growth rate will slow to 5.7% in 2016, with shipments projected to be about 1.5 billion in total.

Adoption rates in mature markets are at all-time highs, so most of the industry's growth will come from emerging markets such as India, Indonesia, the Middle East, and Africa.

The slowdown in mature markets will have dire consequences for makers of high-end hardware, including Apple and Samsung, according to IDC. Average selling prices for handsets was around $295 in 2015, but IDC predicts that will drop to $237 by 2020. The good news for phone makers is that when people upgrade to new phones, they're more likely to buy a larger, pricier phablet.

"Consumers are still migrating upstream with regard to device size as phablets continue to grow in popularity," Anthony Scarsella, research manager with IDC's mobile phones team, wrote in Thursday's report. "Phablets now account for 20% of all smartphone volumes in 2015, with expectations that volumes will grow to 32% in 2020, or 610 million shipments" for Android handsets.

Apple's iPhone phablet sales will climb from 26% today to 31% in 2020.

Apple's move into the trade-in space will be key to helping it sell iPhones, especially in mature markets. The combination of installment plan pricing and trade-ins will allow Apple to "more tightly control the trade-in offerings, as well as monitor the demand for where these perfectly functioning 1-year old iPhones end up," Ryan Reith, program director with IDC's Worldwide Quarterly Mobile Phone Tracker, wrote.

Are you prepared for a new world of enterprise mobility? Attend the Wireless & Mobility Track at Interop Las Vegas, May 2-6. Register now!

iPhone shipments reached 231.5 million in 2015, but IDC doesn't think Apple will be able to grow shipments all that much in 2016, even with the iPhone SE on deck. The trade-in program will help kick-start growth again in 2017 as it expands to more markets. Even so, Apple's marketshare is likely to dip from 15.2% in 2015 to 14% by 2020.

Android will ship on the lion's share of devices over the next few years.

Android phone makers pushed 1.17 billion phones during 2015. That number will swell to about 1.62 billion in 2020, says IDC, giving it about 85% of the market. Few Android devices will target the high end, with only about 14% of all Android handsets costing more than $400. Phone makers will be chasing thinner and thinner profit margins as emerging markets scoop up low-cost devices.

Windows Mobile is facing a murky outlook at best. The platform saw shipments drop 18% through 2015 to just 11.1 million units in total. Microsoft's mobile operating system may drop to less than 1% of the market over the next few years.

About the Author(s)

You May Also Like