Communications May Take Brunt of Next Chip Material Shortage

China’s plans to limit exports of certain chipmaking elements could affect the telecom space more than other sectors, says Forrester analyst.

Last week, when word came that China intended to cut back on exports of germanium and gallium starting in August, some reports pointed to the electric vehicle and semiconductor markets as being likely to feel the pinch. An analyst from Forrester, however, believes telecommunications may take a hit from such a shortage.

The tug-of-war on trade between China and the United States continues to spread to additional fronts, this time concerning chipmaking materials. China’s abrupt announcement to limit its gallium and germanium exports is the latest maneuver for leverage in the global sociopolitical economy.

Glenn O’Donnell, vice president, research director with Forrester, says this might not have a huge impact on semiconductors because germanium is not as vital as it once was to semiconductor production. “It was the original material when it was invented way back in the 40s, but silicon is the most prominent base material now as opposed to germanium,” he says.

Where It Might Hurt

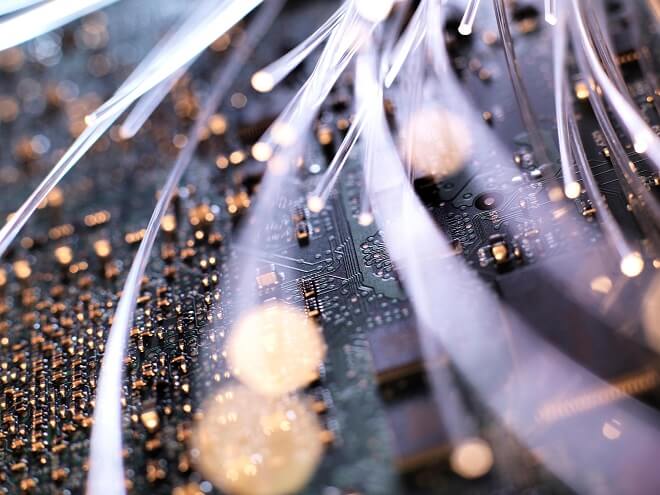

Germanium and gallium do see use in optics and optical systems, O’Donnell says. “I think you’ll see more of an impact on telecommunications equipment and telecommunications providers than you will on enterprises and cloud providers, to be honest.”

If the restrictions on exports become ugly enough, it could become a problem for telecommunications, he says. “For the telecommunications carriers and the companies that provide them with their equipment, that could be an issue. Could we see things like 5G rollouts get impacted? Maybe.” O’Donnell says telecommunications companies use fiber optics run with equipment -- which fires the light beams down those fibers -- that is dependent on these materials.

Overall concerns about chip shortages persist because of delays seen during the height of the pandemic, stemming from supply chain issues and other woes. In response, the market sought ways to adapt and learn from those supply problems. “Since COVID, the supply chains have become more robust,” O’Donnell says. “Our dependence on a single supplier is something that people just are not doing anymore, regardless of what it is. So having a more diverse supply chain has become important for everybody.”

Supply Chain Diversity Could Help

Even if there is a risk of not having access to materials from such places as China or Ukraine, he says companies have built up some diversity in their supply chains. “They may not be able to get as much as you can get from China, but they’ll still get it,” O’Donnell says.

At the very least, the former failings in the supply chain might not be the root cause for any new chip shortages. “One of the reasons we had the chip shortage in general was because the supply chain just completely fell apart,” he says. “And it wasn’t just getting the supplies out of a certain place. It was also shipping them because all the shipping channels got all bottled up.”

On top of those issues during the pandemic came the strains of classic supply and demand issues, O’Donnell says. “Equipment providers did not foresee the demand that was going to come for things like PCs and since we had to send everybody home, everybody needed a capable PC.” In response, PC sales shot through the roof, he says, which forced PC suppliers to scramble to deliver. That led to chipmakers also scrambling to fulfill that demand. “I think was also a bit of a wakeup call that better insight or better foresight into what could be happening is going to be necessary,” O’Donnell says. “One of the big lessons we learned from all of this is just when you think you understand what’s going on, you don’t. The world has become so unpredictable, but we have to be able to plan for that unpredictability.”

Recycling Old Chips Is Not an Easy Fix

There may be some efforts made to recycle hardware for materials China plans to throttle access to, however such action might be limited. “I suspect we will see some activity around that,” O’Donnell says. “It can be difficult. You can’t take a chip and just kind of pull the germanium out as pure germanium unless you’ve discovered some new manufacturing method.”

Recycling old hardware might yield some germanium, he says, but once the material is put onto a chip, there is an infusion of ions of other materials to create the semiconductor properties needed to make them work. “It’s an altered chemistry of the material,” O’Donnell says. “Stripping out these implanted ions is not exactly an easy thing to do. Can people do it? Technically, yes. Will they try to do it? Maybe, but probably not at massive scale.”

What to Read Next:

As Tech Layoffs Continue, Chip Foundry Plans Become Vital

What Do US Restrictions of China Sales Mean for the AI Chip Industry?

About the Author(s)

You May Also Like

How to Amplify DevOps with DevSecOps

May 22, 2024Generative AI: Use Cases and Risks in 2024

May 29, 2024Smart Service Management

June 4, 2024