Microsoft Battles Google, Amazon In The Cloud

Microsoft CEO Satya Nadella clarified the company's cloud strategy, argued competitors such as Amazon and Google can't match Microsoft's hybrid-oriented approach and enterprise expertise.

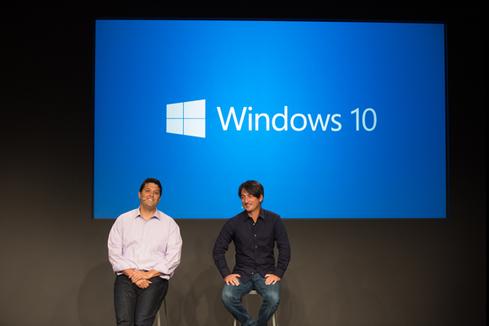

Windows 10: 11 Big Changes

Windows 10: 11 Big Changes (Click image for larger view and slideshow.)

Since making his first appearance last spring as Microsoft CEO, Satya Nadella has championed a "mobile first, cloud first" strategy. The "mobile" part remains a work in progress, with low Windows Phone market share detracting from Office for iPad, Cortana, and other mobile software efforts. The "cloud" component, in contrast, has continued to accelerate -- a point Nadella repeatedly emphasized Monday at an event in San Francisco.

At the event, Nadella and executive VP Scott Guthrie announced several new products for Azure, Microsoft's cloud platform. The announcements include new "G-series" virtual machines, which Microsoft advertises as the most powerful in the public cloud, and a new "cloud in a box" product aimed at hybrid environments. But the thrust of the presentation involved Nadella and Guthrie arguing that Microsoft is poised to defeat Amazon and Google for cloud supremacy.

Nadella and Guthrie listed a number of impressive stats to illustrate Azure's progress. They said Azure-related revenue, which includes income from both hosted infrastructure and hosted services such as Office 365, is on pace for a $4.4 billion annual run rate. The company gains 10,000 new Azure customers per week, and Azure stores 1.2 million SQL databases and 30 trillion objects. Microsoft claims Azure Active Directory boasts more than 350 million users, and that the service processes over 18 billion authentications per week. Some 80% of Fortune 500 companies now use Microsoft's cloud.

Moving beyond the numbers, Nadella and Guthrie said that in the long run Azure will pull ahead of competitors such as Amazon and Google by offering the most complete, enterprise-ready packages. According to the Microsoft execs, Google and Amazon are the only companies that can compete with Azure for hyperscale performance -- that is, the ability to massively scale services on demand, and to use economies of scale to drive down prices. But Guthrie and Nadella said hyperscale is only part of the strategy; Microsoft's attention to enterprise customers will help Azure to pull ahead.

[Another piece of the strategic pie? See Microsoft Brings Containers To Windows, Azure.]

This enterprise attention includes the imminent addition of two new data center regions in Australia that add robustness and security to Microsoft's global infrastructure. With the new data centers, Azure will boast 19 regions -- more than twice what Amazon offers and six times what Google provides, according to Microsoft. Azure is now powered by over 11 million servers.

Nadella and Guthrie said Azure's scale allows Microsoft to run its own products, such as Bing and Office 365, on the platform, and to use what it learns to provide better security, disaster recovery, and reliability for customers building their own systems. But more importantly, the execs said, Microsoft understands that different customers will move to the cloud at different paces, and that some will use cloud services for only certain types of data and workloads. Thanks to this understanding, the company has invested heavily in hybrid products that allow companies' on-premises infrastructure to interface with Azure.

Microsoft has been beating the hybrid drum for a while. Even before Nadella took over for Steve Ballmer, the company was positioning Windows Server as a bridge between on-premises and cloud-based assets, for example. The company advanced that strategy at Monday's event with the announcement of Microsoft Cloud Platform System (CPS), a "cloud in a box" hardware appliance built in collaboration with Dell. Available next month for as-yet undisclosed prices, CPS will combine Azure, Windows Server, and Microsoft System Center. In essence, the product offers on-prem equivalents of many Azure technologies, which should theoretically provide admins in hybrid environments with a consistent Azure experience, regardless of whether they're working with local or cloud-based projects.

Other announcements included new G-series virtual machines. Microsoft claims the VMs, which use the latest Xeon processors, are the largest available in the public cloud, with support for up to 32 cores and up to 448 GB of RAM. The G-series boasts twice the memory of Amazon's largest VMs, according to Microsoft.

The company also announced a new Azure Marketplace that will unify various Azure stores into a single online destination. Cloudera and Hortonworks are among the vendors with products in the marketplace. Microsoft said more than 40% of Azure revenue comes from ISVs and startups.

Microsoft additionally announced that Azure supports CoreOS, a container-based Linux OS. Microsoft has not historically been viewed as a Linux proponent, with former CEO Ballmer famously calling the technology a "cancer." But Microsoft, which has launched more than 300 new Azure features and updates in the last year, now "loves Linux," according to Nadella. The company has been working to enable Azure to run as many workload varieties as possible, and around 20% of Azure deployments now involve Linux.

Nadella also announced Monday that Microsoft will provide free Azure-based research tools to doctors and other medical professionals working to eradicate the Ebola virus.

Who wins in cloud price wars? Short answer: not IT. Enterprises don't want bare-bones IaaS for the same reasons they don't buy many $299 PCs at Wal-Mart. Providers must focus on support, not undercutting rivals. Get the Who Wins In Cloud Price Wars? issue of InformationWeek Tech Digest today. (Free registration required.)

About the Author(s)

You May Also Like