People are talking on social networks and web sites about your products and brands. Using software to listen in takes new skills and tactics.

There's Facebook, Twitter, and the other social networks, plus community-driven websites, all of them generating comments good and bad about your company, products, and rivals. The promise of a never-ending focus group (along with fear of not knowing what's being said about you) has given rise to a fast-growing market for social media monitoring and sentiment analysis software and services. What could be better than letting technology magically comb the Web to bring back and interpret brand-relevant comments?

If only it were that simple.

If you wade even ankle deep into social media monitoring, you quickly realize that it's a much more nuanced problem than spotting positive or negative opinions. For starters, comments often have multiple meanings or gradations of meaning (see "7 Ways Sentiment Is Hard To Decipher Online"). And when it comes to marketing research, the best insights often come with no mention of a specific company or its products.

"The mistake people make is they just listen for brands and miss all the conversations," says Frank Cotignola, consumer insights manager at Kraft Foods. "I tell people who are using this data to flip it around: Listen to what people are saying, and then see how your brand fits in." Knowing what percentage of comments about a barbecue sauce brand are positive or negative may be far less valuable than gathering insight into what people like about barbecuing, how they cook, or how they'd like to cook.

Cotignola and other seasoned miners of social media sentiment--at the likes of American Express, The Wall Street Journal, and the American Red Cross--say it takes a lot of human interpretation to get any value out of sentiment reports. While the technology is driven by marketing in most companies, IT shouldn't sit on the sidelines, as it has a role in expanding use of sentiment analysis across the company.

This Isn't A Survey

Pollsters and the news media routinely use sentiment analysis technology. The Wall Street Journal's Sentiment Tracker is an infographic that shares public opinion about certain topics as expressed on Facebook and Twitter, using sentiment analysis software-as-a-service from NetBase Solutions. Recent topics it has tackled include space-launch vendor SpaceX's taking "One Small (Privatized) Step..." toward a commercial space program and the Mark Zuckerberg "Hoodie-Gate" episode. Out of 1,000 Facebook and Twitter posts on Zuckerberg between May 7 and May 11, 47% were positive about him and his Wall Street backers wearing hoodie sweatshirts while pitching the Facebook IPO to investors, 41% were against it, 4% made comparisons to the Trayvon Martin case, and 8% cracked jokes, such as "Zuckerberg should have the decency to graduate to a pinstriped executive hoodie." (Sentiment analysis can't yet tell if a joke is actually funny.)

The Journal has been careful not to present Sentiment Tracker as a scientific public opinion poll, as Twitter and Facebook users are younger and have higher incomes than the population at large. "It's just very important for us to always make a distinction as to what this actually tells the reader, and not present it as something more than it is," said deputy editor Ryan Sager, speaking at last month's Sentiment Analysis Symposium in New York.

The Journal's editors have talked about weightier uses of sentiment analysis, such as a Candidate Tracker for the current election season. But here, too, they'd have to be clear about the biases of social media. "Ron Paul has always kind of had a very high and very positive Internet buzz because he's Ron Paul, and that's where his audience is," Sager noted.

Research: 2012 IT Spending Priorities Survey

Does IT have a credibility problem? Our full report on IT spending priorities, with an exclusive survey to learn why IT may, is free with registration.

Does IT have a credibility problem? Our full report on IT spending priorities, with an exclusive survey to learn why IT may, is free with registration.

Our report has detailed spending and return expectations for 16 IT projects. The credibility problem? For every one, IT expects to spend more near term but lower tech costs long term. Get This And All Our Reports

Channel Analysis

Product and service companies must also be aware of these "channel biases." At the American Red Cross, Banafsheh Ghassemi, VP of marketing and e-CRM customer experience, says the patterns of interaction differ by phone, postal mail, email, and social media. A giant among charities, with more than 500,000 volunteers and 35,000 employees, the Red Cross monitors social media comments made by volunteers, donors, and other constituents using the SaaS tools of Radian6, which Salesforce.com acquired last year.

"For the Red Cross, social media is typically positive--they're telling us how much they love us," Ghassemi says. "But if they're taking the time to write and email or send us mail, chances are it's negative. They either didn't like something or they wanted to express an opinion or make a suggestion."

Social networks were not, for the most part, a source of love for Wisconsin Gov. Scott Walker during his recent election recall fight. Sentiment analytics vendor Topsy Labs found that tweets related to Walker generated a very low -1.999 sentiment score, while his Democratic opponent, Tom Barrett, registered a relatively neutral 0.932 score. Yet Walker carried 53% of the vote to stay in office. "In Walker's case, Twitter wasn't representative of the electorate, and it points up the need to choose your data carefully and interpret it with these biases in mind," says analyst Seth Grimes, who organizes the Sentiment Analysis Symposium.

Sentiment analysis technologies shouldn't replace conventional research, such as in-person focus groups, Ghassemi says. Focus groups and surveys are important for getting more depth into ideas picked up in social media monitoring. But each channel requires different tactics.

"The traditional researcher always wants to ask questions: Why do you use this product, and why do you use it that way?" Kraft's Cotignola says. "With social media, you just stand back and listen, and you can't ask, 'Why did you say that?' So it's a cultural shift for researchers."

Kraft Foods has developed a Community Intelligence Portal to tap into consumer sentiment across social networks, blogs, and other websites. Like The Wall Street Journal, Kraft relies on the services of NetBase, one of the largest among the growing number of sentiment analytics vendors. NetBase continuously pulls comments from more than 100 million Web sources into its ConsumerBase, a cloud-based database of consumer sentiment accessible via an API. NetBase runs natural language processing, analytics, as well as machine-learning algorithms on top of this big data resource, to help customers spot and make sense of relevant comments.

Cotignola says Kraft tries to "tune into the conversation" rather than just listen for brand mentions. "You have to listen when consumers talk about snacking, listen to what they say about the way they barbecue and what they use, and you have to listen to their emotions and feelings," he says.

The Perpetual Research Machine

Those are some of the limitations of sentiment analytics. But there are several key advantages.

First, social sites are available 24 hours a day, seven days a week, so social media analysis is a real-time tool that's not subject to the time lags inherent in focus groups and surveys. Ghassemi of the Red Cross describes it as a "leading indicator" for her. "You can start to pick up on the signal in the noise right away, and once you spot a trend, you can go into your other channels and use conventional research to figure out what's behind the trend," she says.

Timeliness is essential to the Red Cross because it's often dealing with fast-breaking disasters, such as the earthquake in Haiti, where the nonprofit pioneered the use of text messaging for fundraising, collecting some $40 million within days to support ongoing relief efforts. It also listens to "on the ground" social chatter during disasters to learn where help is needed most. Meantime, it's listening for everyday comments about the brand and people's experiences at blood donation centers and health and safety courses it runs.

By mixing network analysis (who is influencing whom) with sentiment analysis (insight into what they're saying), companies can reach the most important influencers, not just the largest number of people, the way mass media can. Services such as Klout can help companies figure out who the "influencers" are for a particular topic or industry, and some of the sentiment analysis platforms have built-in features or add-ons to assess whether influential groups have positive, negative, or neutral opinions of a company or product.

"Even though the reach of friends and family is much smaller than a TV or radio ad, they're much more influential," Ghassemi explains. "If your cousin announces on Twitter that he just gave blood and that he feels really good about it, chances are you will pay more attention to that than to an advertisement."

However, social channels can approach TV and radio reach if celebrities or big media create or amplify the social content. If that cousin happens to be actor Ashton Kutcher, he'd be instantly telling 11 million people he just had a good (or bad) experience giving blood.

Tracking Trends

A second big advantage of social media analysis is that it lets organizations track changes over time. "If consumers are really hurting, do you want to consider raising prices, or do you want to offer some sort of coupon or online offer?" says Cotignola of Kraft. "The great thing about this kind of data is that you can continue to look at it daily to see how things are trending."

A third advantage is that social media provide so much data about your competitors. The American Red Cross doesn't think of other charities as rivals per se, but Ghassemi notes that the number of charities has doubled over the last decade and that they're all competing for donations and volunteers. "Social media has allowed me to look at any organization within the nonprofit sector to find out what they are doing that's working and what's not working," she says.

Just as for-profit companies have seen the power of social media--as in the 12 million views of the "United Airlines Breaks Guitars" YouTube video, or the incident in which Whirlpool's customer service department displeased a blogger/customer with more than 1 million Twitter followers--the nonprofit world has also witnessed cautionary tales. Susan G. Komen for the Cure, for example, was engulfed in controversy after it pulled funding for Planned Parenthood programs in late January. The breast cancer research charity restored funding a few days later after a (Planned Parenthood-fueled) public outcry on social media and elsewhere, but the brand's reputation suffered.

"We all learned a lot from the Susan G. Komen incident, and we took it to heart," Ghassemi says, including "not letting politics get mixed up with the mission" and using social media listening to get ahead of a controversy before it "takes on a life of its own."

Taking Action

When customer sentiments are positive, you actually want social media to help a message take on a life of its own. Author and American Express executive Christopher Frank calls it "the flywheel effect," and in his book Drinking From The Fire Hose: Making Smarter Decisions Without Drowning In Information, he offers a four-phase approach to putting the flywheel to work: listen, engage, measure, and learn.

Many organizations use sentiment analysis technology to listen to and measure social media comments, Frank says, but few engage customers or quickly learn from social media to gain momentum. Among the exceptions, he says, are Dell and Procter & Gamble.

Dell has a Radian6-powered social-media listening command center, where the mantra posted on the wall is "listen, engage, act." Average daily mentions of the Dell brand on Twitter have a greater reach than the combined circulation of the top 12 daily newspapers in the U.S., according to Dell. The company responds to service-related questions and complaints and monitors for consumer tastes and trends.

Now Dell's trying to market its experience: the American Red Cross, for example, worked with Dell to launch the Red Cross's Digital Operations Center in March.

Procter & Gamble was listening to the social buzz in late February when workers at the Daytona 500 were shown on national TV using Tide detergent to clean the track after a crash and fuel spill. Within days, P&G created a TV commercial, posted on YouTube, using footage of the incident. As a sportscaster narrated, talking about "a new use for laundry detergent," captions read: "You keep inventing stains … we'll keep inventing ways to get them out."

"P&G was just tracking the Tide brand, and all of a sudden their monitoring system just lit up," Frank says. "Their social team responded quickly, and it speaks to the capability of being agile."

At American Express, where Frank is VP of the Global MarketPlace Insights Team, the company scrapes 150 million Web sources in search of comments made in several languages. It has built a data cube that contains some 5 million conversations about the company, and it uses this resource, powered by a listening platform from Visible Technologies, for product and market research across the company.

A separate department within American Express responds to individual customer complaints and questions on social media. But Frank says the company is moving toward centralized approaches and standardization of tools.

"Social usually starts with marketing and the product groups on the front lines with the customers, but very quickly you need to loop in IT to build out the capabilities," he says.

Choosing Technologies

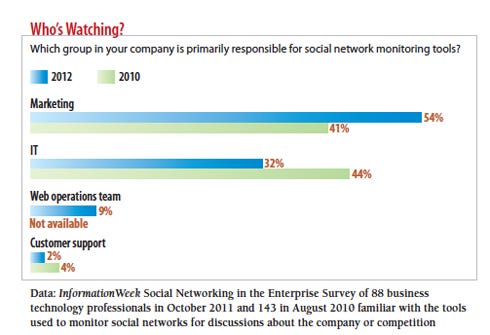

According to InformationWeek's 2012 Social Networking in the Enterprise Survey, 54% of respondents familiar with their organizations' social networking monitoring tools say marketing holds the primary responsibility for these tools. IT is in charge at about one-third.

Social media is one tech spending area, along with Web analytics and marketing automation software, that is increasingly being led by chief marketing officers. Most often they use cloud-based service providers, such as Radian6 and NetBase, for the foundational monitoring of social media. Those vendors handle the monitoring of data feeds from the likes of Facebook and Twitter, and the screen scraping from other Web sources that don't offer APIs.

American Express decided to develop its core social database in-house to give it unfettered access to and control over the data. American Express blends its data with psychographic and demographic data from third-party providers to support fine-grained customer segmentation and targeting. Companies analyzing sentiment about just their own brand and industry may find an in-house resource doesn't have to involve huge data volumes. Plenty of companies have built social media applications without getting into exotic platforms such as Hadoop. And about half of companies in our social networking survey monitoring their companies' brands rely on search alerts from Google or Bing.

Other functions needed on top of monitoring include CRM-based routing capabilities, to send product queries to employees able to respond to comments. Some companies will want publishing and management software with workflows that require an employee to get approval before posting something; such software might also make it easier to reuse content to answer oft-asked questions. Conversion-tracking features help companies turn comments into sales leads.

Deeper analysis and understanding of comments requires natural language processing capabilities, and many specialists in this software, such as Lexalytics and Lithium, have partnerships with social media management platform providers. Measurement capabilities help companies establish baselines on customer sentiment and then track the effectiveness of advertising, public relations, and social media campaigns.

Frank says social media will increasingly be seen as just a part of the classic marketing funnel: moving people from product awareness to buying consideration to buying to advocating for the product.

With that context in mind, while a lot of sentiment analysis dashboards highlight the red, negative sentiment versus the green, positive ones, "I'm trying to crack the code on the neutral sentiment," Frank says. Those are would-be buyers without entrenched feelings to overcome who can be moved to buy. In an election year, the parallel use for social media monitoring is to tune into and influence those all-important swing voters.

Go to the sidebar:

7 Ways Sentiment Is Hard To Decipher Online

InformationWeek: June 25, 2010 Issue

Download a free PDF of InformationWeek magazine

(registration required)

About the Author(s)

You May Also Like