Microsoft Faces 4 Big Challenges

Microsoft CEO Satya Nadella is riding high with analysts and investors -- but look at the remaining hurdles.

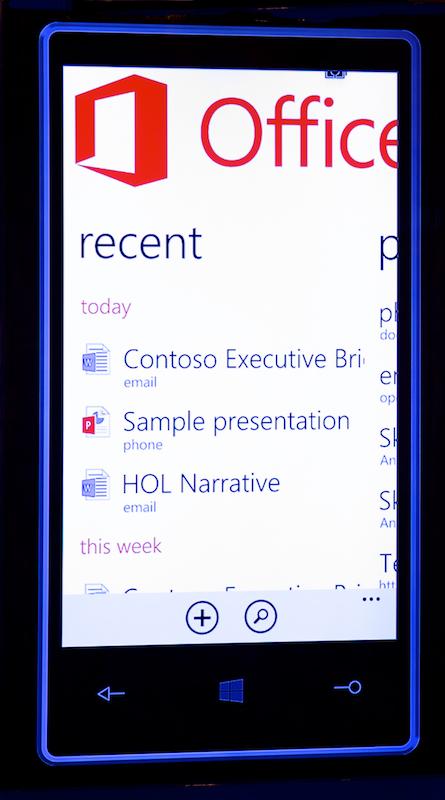

Microsoft Office For iPad Vs. iWork Vs. Google

Microsoft Office For iPad Vs. iWork Vs. Google (Click image for larger view and slideshow.)

It's been an eventful few days for Microsoft, but new CEO Satya Nadella appears to have emerged with investors still on his side. Last week, he announced plans to lay off 18,000 workers. This week, his company announced earnings that would have been unequivocally strong had it not been for profit losses tied to its $7 billion Nokia Devices and Services acquisition, which accounts for two-thirds of the layoffs. Despite the tumult, and thanks to the quarter's stellar cloud and server revenue, Microsoft's stock has held steady since the job reductions were announced; within striking distance of $45 per share, it's also up more than 20% since Nadella took over.

But that doesn't mean Microsoft has nothing to worry about. The company had plenty of strong financials to crow about during the most recent quarter, but Nadella's popularity hasn't just been about numbers. It's also been about his willingness to admit that Microsoft faces an uphill battle in many markets, notably smartphones and tablets. By initiating layoffs, Nadella has taken a big step toward installing the "challenger mindset" he says his company needs -- but many steps still remain. Here are four pressing questions Microsoft and its new CEO must still face.

Figure 1:

1. Will Nokia fit inside Microsoft?

Over the last week, Microsoft execs have gone out of their way to emphasize that the company is scaling down its device efforts. Yes, it will still make devices, because Windows Phone needs the help and because Microsoft wants devices that show off what its cloud services can do. But Nadella clearly knows some investors are leery of Microsoft's hardware ambitions, and he and other senior leaders have appeared determined this week to circumvent new concerns.

[For more insight on Microsoft's device strategy, see Nadella's Windows 9 And Device Plans, Explained.]

"We're not in hardware for hardware's sake," Nadella said during this week's earnings call.

That sounds good -- but what does it mean for Nokia? Microsoft execs spoke optimistically this week about Windows Phone growth in emerging markets, but they conceded that low-cost (and thus low-profit) devices drove most of the sales. Nadella said that, to generate high-end demand, Microsoft will create devices that "light up" Microsoft's digital services, such as Cortana, OneNote, and Office Lens. Will it work? Time will tell, but we'll know more after we see Microsoft throw its efforts behind a new flagship phone.

In the meantime, Microsoft will have to contend not only with Android, which is particularly dominant in the low-margin markets where Windows Phone has some traction, but also with the iPhone. Apple's smartphone could pose a particular challenge to Nadella's plan to situate Windows as the premier smartphone OS for productivity. Apple devices are already popular in the enterprise, could enjoy revitalized consumer growth when rumored phablet models arrive this year, and now have the backing of IBM's enterprise software and salesforce.

2. Will Microsoft's hybrid cloud synergies continue to click?

Nadella's cloud-focused strategy looked particularly promising after this week's earnings report; Microsoft said commercial cloud revenue was up 147% year-over-year and is on pace for a full-year total of more than $4.4 billion. Moreover, execs said the cloud momentum -- which includes products such as Office 365, Azure, Exchange Online, SharePoint Online, Dynamics CRM, Lync Online, and Intune -- isn't cannibalizing its on-premises products.

"We don't see it as a zero-sum," Nadella said this week.

Indeed, Microsoft also reported server products were up 14% from the same quarter last year. The implication is that hybrid cloud flexibility is helping customers to find the right balance

between managing resources on-site and moving some work to the cloud. Amazon still beats Microsoft in total cloud revenue, but Microsoft could win out in the long term, because it is building bridges between Azure and customers' infrastructure, which theoretically allows on-premises environments to move specific operations to the cloud at their own pace.

Microsoft has also upsold basic Azure customers to premium cloud services. CFO Amy Hood said this week that more than half of Azure customers also use products such as Microsoft's Enterprise Mobility Suite, which launched this year. Cloud resources such as storage and compute could become commoditized and thus subject to lower margins, so Microsoft's ability to add up-market services could prove another ace in the hole.

All of that sounds promising -- so where's the problem?

In many conversations, Microsoft's strategy has been reduced to "cloud" in recent months. But looking at where its revenue comes from, Microsoft is still more a server company. In the most recent quarter, its "Commercial Licensing" revenue, which includes income from server products and Windows Commercial, accounted for nearly half of the company's overall revenue. "Commercial Other" -- home to its business-oriented cloud services and their vaunted 147% revenue growth -- accounted for less than 10%. That's not necessarily a problem as long as synergies between server products and Azure continue to shine, but it puts into context where Microsoft gets its revenue.

[For more insight on Microsoft's place in the industry, see Microsoft Earnings: 3 Big Takeaways.]

Ultimately, Microsoft's cloud is growing quickly, but it's still a small piece of the pie. With Windows revenue potentially unsteady and costly device efforts still being brought under control, Microsoft's critics will be sensitive to any lapses in Azure momentum.

Moreover, as it gains more cloud customers, it could become harder for the company to maintain the synergies that seem to be working well today. It also remains to be seen how Nadella will balance openness, evidenced by deals with Salesforce and SAP, with strategic strikes against competitors.

3. Can Windows rebound?

Windows still holds more than 90% of the PC market, but Windows 8 and 8.1 hold only around 12%, according to the web-tracking firm Net Applications. In the short term, this struggle hasn't impacted Microsoft's books as much as you might think. Windows revenue was actually up in the past quarter, thanks largely to business upgrades compelled by Windows XP's end-of-service deadline. But most of those businesses moved to Windows 7, not Windows 8.1. Microsoft's consumer Windows business, meanwhile, is as poor as it's been in recent memory. Windows is clearly living more on its past glories than on Microsoft's newest strategies.

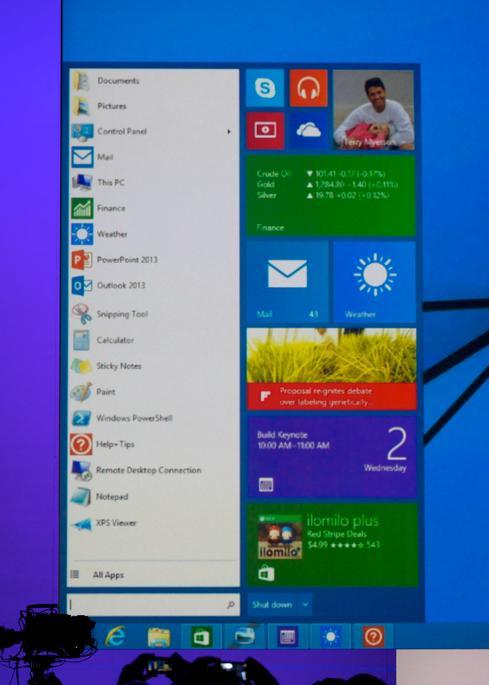

Figure 3:

Execs have shown only glimpses of the next version of Windows, which will converge Windows Phone, Windows RT, and full Windows into a single framework. Crucially, the desktop UI will have a Start menu. But will it help Microsoft maintain its PC dominance as Chromebooks eat into the low end and Macs remain popular at the high end? Will the Windows PC user base help the OS gain share on other form factors? Microsoft has

only 14% of the overall computing device market, which includes smartphones and tablets in addition to PCs.

4. Will next-gen productivity experiences live up to Nadella's hype?

Right now, Microsoft Office sets the standard for productivity, but for many users alternatives such as iWork or Google Docs might be good enough. This broad parity, however, supposes that most users think of productivity in pretty old-fashioned terms: basic word processing, basic spreadsheets, and so on. Nadella believes Office will remain king not only because it remains the most sophisticated option for traditional productivity, but also because it will become a platform for entirely new types of productivity.

"We believe productivity experiences will go beyond individual applications to deliver ambient intelligence that spans applications," Nadella said this week.

Figure 4:

Delve, one upcoming Office 365 product, acts like a sort of "Facebook newsfeed" for the workplace, for instance. It uses cloud-driven machine learning to observe how, on what, and with whom you work, and then it attempts to surface useful information intelligently when you need it. At a high level, the technology, as Nadella recently put it, challenges the assumption that people know what they're looking for when they conduct a search.

Other examples include natural language queries in Power BI, a feature that Microsoft says can help companies build data cultures by making analytical tools more accessible. During this week's earnings call, Nadella also illustrated new breeds of productivity with allusions to Windows Phone 8.1 personal assistant Cortana, and the Surface Pro 3's digital ink technology.

It's good for Microsoft to center its focus on one of its strengths: productivity. It's also good for Microsoft to think about ways it can disrupt the status quo. But will personalized Office experiences truly revolutionize how we work or just give Microsoft new features to round out its catalogue?

Cyber-criminals wielding APTs have plenty of innovative techniques to evade network and endpoint defenses. It's scary stuff, and ignorance is definitely not bliss. How to fight back? Think security that's distributed, stratified, and adaptive. Get the Advanced Attacks Demand New Defenses report today (free registration required).

About the Author(s)

You May Also Like

How to Amplify DevOps with DevSecOps

May 22, 2024Generative AI: Use Cases and Risks in 2024

May 29, 2024Smart Service Management

June 4, 2024