Q&A: Aflac US CIO Shelia Anderson Talks AI, Data, and Cloud

Automating claims processing and other functions currently see more play with the insurer than ChatGPT, but Aflac’s AI journey is still underway.

While the rest of the world falls over itself bolting generative AI into their IT operations, insurance company Aflac seems to be focusing on practical uses of AI that speak to its core business. The automation of claims processing is one way the company aims to save its staff time and energy, along with speeding up payments to recipients.

There are other matters from data management to privacy that insurers must also address as awareness and regulation of those spaces escalate. Shelia Anderson, CIO of Aflac US, spoke with InformationWeek about the approach she is taking in her role and the company’s journey with cloud and AI.

What are some key technology leadership goals you have as CIO for Aflac? What are the major concerns that you address from a strategic perspective?

I’ve been with Aflac now about eight months. I’ve had the opportunity to assess the organization and direction. We actually have an Aflac digital strategy that we're still following. As I look at the organization, one of the things is what I’ll call focusing on the foundation.

We absolutely are looking at some of the building blocks to technology to enable that we can grow in the future. And some of those things would be some of your standard improvements around IT service management, implementing ServiceNow, implementing a very strong financial acumen, implementing technology business management. Those are just a couple of the foundational elements that we are focusing on.

One of our other goals is very much focused on delivering for our customers and being 100% customer obsessed. That basically means working in partnership with our customers and our business partners to deliver the value that they’re seeking in their technology investment. We’re also looking, of course, at driving value through innovation and leveraging of new capabilities, such as AI and machine learning. That’s just one of many ways that we’re driving value for the business.

Underpinning all of that is absolutely looking at our talent strategy as well. As you can imagine, all technology organizations today are in some form of transformation and in the middle of upskilling, reskilling, and hiring for that future state that they’re moving towards. Those are some of the key things that we’re working toward this year.

Are there other factors shaping the insurance technology landscape, such as the ways consumers want to interact? Are there concerns within the industry and how it functions that are part of how you form strategy?

Yes. As I mentioned before, customers are at the center of everything that we do. And of course, behaviors, customer behaviors, and those experiences that they are accustomed to in everyday life. That’s something that all of us in business have to strive toward as well. We have a digital enablement team that designs most of our customer experiences and our customer journey. So, we stay very much in tune with our customer feedback, in the lens of the customer as we’re designing for the future.

There are many new considerations now in terms of data privacy and data as a whole -- how it’s processed, what companies keep data, and what data companies see. Has this influenced your operations?

As you can imagine in insurance in general, data is widely available. We have a lot of data and information, of course -- that is something that underpins all of the work that we do.

We are looking at our data strategy. What data do we have? How do we best leverage that to serve our customers? And then, of course, to ensure that we are maintaining the integrity of that data and that we have a secure practice going forward. We have a whole security organization that absolutely is focused on managing and maintaining the security of that data as well as all of our secure coding practices across the organization.

So that’s top of mind for us. We have opportunities like many companies do to look at improving that data, making sure that we’re retaining only the data that is needed to be retained, and of course, leveraging that to benefit our customers at the end of the day.

Has the evolving regulatory space when it comes to privacy also been top of mind? There are different legal questions based on countries and different localities and whether or not there’s going to be a US national policy on that.

In the insurance industry, the compliance and regulatory aspect is a big piece of the considerations that we have as we develop any new capability. So that’s always top of mind for us ensuring that we are in compliance with the regulatory guidelines.

When we introduce new products and rate structures, all of that within the insurance industry, we have a lot of filings that we have to do so we’re always in compliance. With respect to everything that we do. Of course, on the data side, it’s the same thing, really looking at what’s the minimum amount of data that’s required to do the job that we need to do. For the data that we do have, we are ensuring the overall security and integrity of that data for our customers.

Let’s talk a bit about emerging technology. The shiny object everyone talks about now is generative AI. What approach are you taking with that, and how readily do you engage with emerging technologies?

We have teams within my organization that are functionally aligned, so I have the data and analytics team that works very closely with our business account on the analytics side. That combined business and technology team works as one team together. We look to seek out use cases and opportunities in the marketplace. On the emerging technology side, we also have an innovation lab called Hatch here at Aflac. We often leverage that lab along with resources out of my organization to test out some of these emerging capabilities. So yes, we have some [tech] that we would say, “Okay, these are ones to watch.”

And then we may have others that we would move into the lab to do some form of testing, proof of concept to see how it might apply to solving business opportunities within the industry specifically for insurance.

In the industry, with any big capability like [generative AI], there’s also concerns around the use of it in business, some of that I would say is the ability to generate that language capability on the fly. It’s all dependent upon how you’re training those models in the data that goes into it. And there’s also questions around who owns that data, who owns the output.

I think for ChatGPT, that’s going to be an emerging area. The whole focus of generative AI will bring about some other areas that will need a little bit more focus as companies start looking to leverage that inside of their organizations.

Within Aflac, not generative AI, but with general AI there are some ways that we found value across our organization. We started that journey prior to my being here at Aflac, so I’m very thankful that they had already had that vision to start on the journey of leveraging AI in the business. That started in 2022, and then we implemented it as a combination of AI and machine learning, focusing on our claims processing area, focusing on how do we adjudicate claims and process claims more efficiently and more accurately.

If you think about it prior to leveraging the approach to AI, during COVID there was this huge need to really continue transacting business that came across with the pandemic. So in lieu of all of our face-to-face interactions that are very typical for Aflac, we have to think about, “How do we digitally enable some of these customer experiences so that we can continue business?”

Our initial focus was on the accident, health, and short-term disability lines of business. Our claims processing can be quite complex. There are a lot of rules on insurance, as you know. Our goal was to simplify that and to take a look at some of our lower complexity claims and find a way to more efficiently adjudicate those and then provide a more timely payment to our policyholder.

Today we have about 46% of our claims that are actually fully automated. We call it straight-through processing. Those are primarily in the wellness area. Those, for example, were great cases because they don’t require a lot of additional proof. There’s questions and answers on the claim that we can basically accept without attestation from our policyholder.

So, a little bit of a more simple, streamlined process. If you think about our claims set in the beginning, we actually have, I think, about 49% of our claims that have payouts of less than $200. Most of those are what I would call lower-complexity claims. And because of that, we have a great opportunity to automate those claims. That’s where our focus has been.

Of the resources you use, do any of them stand out as really transformative for Aflac or from an insurance sector perspective as game-changing for operations?

In insurance, most people will tell you the claims process can be quite complicated. I think if you can start leveraging artificial intelligence with some of these foundational types of situations, you can learn from that and build upon it, and perhaps leverage it in more complex situations in the future. It may actually expedite processing enough that you can truly shorten your time to adjudicate claims and time to deliver ultimately your payment to your policyholder at the end of the day.

Right now, many organizations are reorienting themselves. Are there any technology resources that in months or years prior were relied on that are now being shifted away from?

One of the things that’s part of our journey, that is foundational for us is our journey to the cloud. We do have some pivots away from on-prem, hosted service, for example, and we’re taking a very hard look at our journey to the cloud by moving our full distributed footprint to the cloud in the next two years. We’re in the middle of that journey. Then we’ve separated out our mainframe journey. These are things that you will commonly hear most companies are in the middle of.

What other technology elements are you looking forward to? Are there other potentially explorative areas of new technology that would be great if they were to come into play?

For us, of course, it is the AI journey right now. We’ve just hit the tip of the iceberg with respect to this. I think the more clarity that we get around our data, our data models, and our data strategy for the future when we have more, cleaner data, we will have endless opportunities to leverage models to better serve our customers and to also improve our overall operational effectiveness as a company.

What to Read Next:

What Does the Arms Race for Generative AI Mean for Security?

Microsoft Brings Generative AI to Low-Code Platform

Q&A: US Patent and Trademark Office's CIO on Cloud and DevSecOps

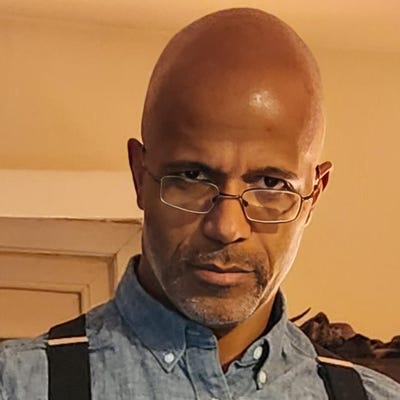

About the Author

You May Also Like