Small Business Economic Forecast: Cautious, With A Chance Of Pay Cuts

A CDW survey finds that as the economic malaise drags on, less than half of SMBs are still optimistic about growth. SurePayroll, meanwhile, also notes drops in optimism, perhaps because small business salaries are taking a dive.

A CDW survey finds that as the economic malaise drags on, less than half of SMBs are still optimistic about growth. SurePayroll, meanwhile, also notes drops in optimism, perhaps because small business salaries are taking a dive.The SurePayroll study, to be released Friday, has some good news, as October small business hiring grew slightly month to month, and is up 2.2% this year. But those jobs may not be paying much. Small business salaries have dropped a whopping 7.3% this year. It seems all those "furloughs" are having an effect.

SurePayroll rates small business optimism at precisely 50%, "one of the lowest levels of the year." The company blamed declining salaries, less money being pumped into the economy, and delays in the governments plan to boost credit to smaller companies.

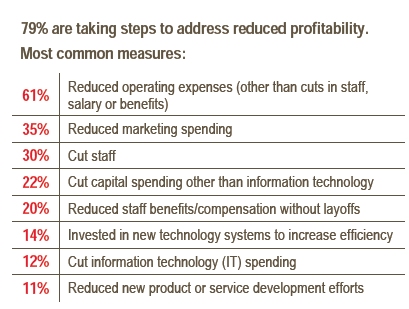

The CDW survey -- Upwind In The storm: CDW Report on Small Business Resiliencewas fielded in July, but strikes many of the same notes with a longer-term perspective. Only 45% small businesses (fewer than 100 employees) say they're optimistic on their prospects for the next five years. And 79% are taking steps to address reduced profitability:

But while they're cutting back on some marketing efforts:

34% Print and/or broadcast advertising 27% Direct mail programs 25% Sports/event advertising

They're actually boosting spending on some tactics:

56% Sales outreach 48% Social media/Web 2.0/blogging activities 47% Web site enhancements 44% E-mail marketing 39% Measuring marketing results 35% Promotional sales

But while 90% of companies with 20 - 99 employees have financial plans, 28% don't reviewing spending against that plan every month. (Among companies with fewer than 20 employees, 72% have a financial plan, but 34% don't review spending against it monthly.) Similarly, 44% don't have a marketing plan and 57% don't have a marketing budget.

The CDW report also notes a clear sense of shoulda, woulda, coulda in how businesses prepared for the recession. If they knew then what they know now, SMBs would have done more to save money during good times and adjust marketing investments and cut expenses quickly when things turned ugly.

Specific quotes on how they wished they'd done things differently include

Build reserves, increase target marketing

Act quicker to reduce operating expenses and looked earlier at creative ways to increase sales

Focus on better strategic planning

It's not too late, of course, but it's much harder to do those things in this economy (ITE) than it would have been when times were good.

Don't Miss: Financial Crisis Survival Kit

Follow Fredric Paul on Twitter @ http://twitter.com/TheFreditor Follow bMighty.com on Twitter @ http://twitter.com/bMighty Put a bMighty toolbar on your browser Put a bMighty gadget on your iGoogle page Get bMighty on your mobile device

About the Author

You May Also Like