Six Steps to Better Sales Forecasting and Demand Planning

Most companies are immature and uncoordinated when it comes to sales forecasting and demand planning. Follow these six steps to increase forecast accuracy, speed planning cycles, reduce inventory costs, end stockouts and increase customer satisfaction.

Few activities are as important to the success of a company as sales forecasting and demand planning. The difference between adequate and excellent sales forecasting and demand planning can make a significant difference in a company's competitiveness and market position. Yet for most companies, excellence in these core business functions remains out of reach.

This article is based on a recent Ventana Research study entitled "Sales forecasting and Demand Planning: Setting the Agenda for Improving Core Processes." Sharing the study's top-level results, this executive summary details mistakes companies make, capabilities they lack and obstacles executives encounter as they seek to improve their sales forecasting and demand planning efforts. It also explores the people, process, information and technology foundations of sales forecasting and demand planning (SF/DP), and it concludes with a recommended six-step SF/DP improvement program.

A Matter of Maturity

Most companies are only beginning to look at sales forecasting and demand planning as two interrelated activities. Ventana Research applied its Maturity Model analysis to assess responses from 209 qualified research participants (out of 784 executives surveyed) and found that most organizations are decidedly immature in this area. The Ventana Research Maturity Model categorizes maturity into one of four levels:

Tactical - The company does not have an integrated sales forecasting and demand planning process. The information that the processes produce is not very accurate or timely, and the responsibility for managing the process and providing the plans often is left to people not directly in touch with buyers and customers.

Advanced - The company has taken steps to make the process more integrated and incorporates a wider range of data in developing its forecasts and plans. More of the right people are involved in producing the plans, and the company produces them faster and in shorter cycles. Yet accuracy still lags, and the plans and forecasts are not timely enough.

Strategic - The company has integrated sales forecasting and demand planning. It brings the people closest to the customers into a highly accurate process. The company emphasizes the importance of accuracy by measuring and rewarding it. It collects detailed information to use in the forecasting and planning efforts so that it can identify more of the root causes for exceptions that occur.

Innovative - The company has a collaborative sales forecasting and demand planning process that incorporates the people who are most knowledgeable and best equipped to manage the process. It reforecasts and replans frequently, and because it has developed this skill, it is able to do it within the shortest possible cycle time.

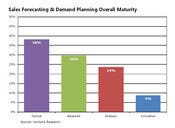

Sales Forecasting & Demand Planning Overall Maturity

(click image for larger view)

Overall, more than one-third (38 percent) of respondents rank at the lowest, Tactical, maturity level, and two-thirds (68 percent) are at the two lowest of the four levels (see chart at right). Those at the Innovative level of maturity, only 9 percent overall, understand the importance of integrating forecasts by the sales department, on the one hand, and the demand plans that drive the operational aspects of a company and the financial budgets that stem from these on the other.

The distribution of maturity was very similar in each of the four component categories by which Ventana assessed maturity: People, Process, Information and Technology. In no component were more than 10 percent of survey participant organizations in the Innovative category, and the largest percentage of firms were in the Tactical category across all components.

The Impact of Failure

When it comes to sales forecasting and demand planning, ineffective use of information and technology has tangible impacts. Companies find that inaccuracy of sales forecasts contributes to customer dissatisfaction and increased inventory cost. For example, retailers are pressuring consumer packaged goods (CPG) companies to minimize stock-outs, and pricing pressure and markdowns result in net reduction in gross margins. Yet few CPG participants in the research have accurate forecasts: Just 8 percent achieve better than 80 percent accuracy, compared to 37 percent of other industries.

Shorter product life cycles are shrinking the time companies have to succeed in the market. Inefficient trade promotions also dampen performance. Ventana's 2006 benchmark research covering scorecards and dashboards and sales and operational planning (S&OP) revealed that companies place a high priority on optimizing sales, revenue and profitability yet that place too little emphasis on optimizing production, logistics and fulfillment, all of which are vital to long-term success. For example, among companies that sell into retail, only one-fourth of participants that have accuracy of more than 80 percent in their demand plans said they have orders cancelled frequently or sometimes. In contrast, more than half of those that have a less accurate demand planning process experience cancellations more often.

To be effective, the demand planning process must span the organization and cross functions. Yet it is not always easy (or even feasible) for many companies to integrate plans across departments, sales pipelines, demand forecasts, revenue expectations and products. Organizational issues can contribute to the difficulties. Ventana found that one of the factors in companies at the Tactical level in the People category (47 percent) is that they delegate primary responsibility for the sales forecast to the wrong people — that is, to product management, finance or supply chain managers. Similarly, they have the wrong people — in sales or manufacturing — create the demand plan.

Process design and quality of execution have major impacts on overall effectiveness. The Tactical companies (43 percent) update their sales forecasts and demand plans no more often than quarterly, in some cases annually, and take more than one month to prepare them. At the Advanced level (22 percent), companies plan and forecast more often (monthly) but still take several weeks to prepare them.

Most firms also fail to take advantage of the improvements that information technology can provide in their sales forecasting and demand planning activities. IT enables them to collect, analyze and distribute a much greater variety of information than ever before, but Ventana's research shows that these technologies have not been widely adopted. Companies at the Tactical or Advanced maturity level for Technology (63 percent) rely on spreadsheets and ERP systems to handle these tasks. Companies at the higher Strategic and Innovative levels of Technology maturity (37 percent) have adopted dedicated planning and forecasting applications that provide multidimensional views of data and that support account-level plans and statistical forecasts.

For most organizations, the understanding of what's possible is limited, so they fail to seize the opportunity to make better use of information and collaboration to improve the effectiveness of sales and operations. Ventana Research recommends senior executives take a close look at sales forecasting and demand planning and assess how well their company is performing them in the context of what the most advanced companies are doing today.

What To Do Next

Many companies are trying to improve sales forecasting and demand planning so they can enhance profitability, improve customer satisfaction and gain competitive advantage. Unfortunately, most firms do not approach their forecasting and planning activities strategically. Typically that's because there are pieces missing from the necessary array of people, processes, information and technology components that support better execution.

People. Ventana's maturity assessment found that 47 percent of firms are at the lowest Tactical level. These companies have only basic capabilities when it comes to delegating responsibility, setting and communicating strategy and objectives, aligning actions across the organization and enabling interaction between business units and throughout hierarchies during the planning and forecasting processes. Participation in the processes is limited and the wrong people (or not enough of the right people) have responsibility for managing them. There are no incentives in place to encourage more accurate sales forecasting or demand planning (and, not surprisingly, a low level of accuracy in both).

Addressing the People elements needed to improve sales forecasting and demand planning may not be technically challenging, but it nonetheless may prove to be the most difficult dimension to address effectively. The move to a more integrated set of forecasting and planning processes will require more information-sharing and collaboration than a majority of companies have today. This means having high-level executive sponsors who clearly communicate strategy and connect it to specific objectives that the company measures. If they do it right, organizations will have more of the right people managing these processes and in the information loop. And forecast or plan accuracy (among other desired results) will be measured and rewarded.

Process. Process is another immature aspect of SF/DP. About two-thirds (65 percent) of organizations are at one of the two lowest maturity levels. In general, forecasting and planning frequencies are low, and it takes a relatively long time to prepare them. The two are probably related, but not in a positive way — companies that replan and reforecast infrequently think they have a long time (or that it should take a long time) to do so. Moreover, these companies lack a formal sales and operations planning (S&OP) process — a set of coordinated planning and decision-making actions that not only balance product supply and demand but also link day-to-day operations with business goals, operational planning and financial planning. The purpose of S&OP is to enable decision-makers to reach consensus on a single operating plan that allocates critical resources purposefully to reach corporate performance targets. Companies at low levels of Process maturity take longer to react to events such as outages, and their planning process is confined within their own four walls. For those that work with retail customers, there is no formal attempt to incorporate their views and the requirements of specific stores.

The key steps in advancing Process maturity are to increase the frequency of planning and forecasting and to reduce the cycle time required to complete the processes. Doing this will require executive sponsorship, since it is a core change management action. Implementing an S&OP process is also both ambitious and necessary. Your company may decide to implement S&OP after the sales forecasting and demand planning initiative or before it; the two are complementary, and having done one, the other will be much easier to put in place. For companies that sell into retail channels, the increased interaction and coordination with channel partners on forecasting and planning will have a positive impact on performance.

Information. The information infrastructure that companies work with is somewhat less of a problem than the People and Process dimensions of SF/DP according to Ventana's study. Only 36 percent or organizations are at the most basic Tactical level. However, another 34 percent are only at the Advanced stage, and just 10 percent are Innovative. Most companies over the past 10 years made major investments that improved the richness and accessibility of their enterprise data. Unfortunately, from a competitive performance standpoint, these improvements are now table stakes, and companies must expand the scope of information available. For example, the study shows that few sales forecasts incorporate product-level data, yet this is the degree of detail required to produce a demand plan. Forecasts also do not track promotions and their effectiveness or other events that affect sales. The accuracy of plans and forecasts in these companies are suspect because gaming is rife. Also, sales pipeline data is not widely shared. Companies that sell into retail do not track sales performance at the store level and do not account for lost sales at that level — information necessary for more effective performance measurement and for demand planning accuracy.

For many companies, expanding the scope of information will not be especially difficult, since many companies have the ability to collect more data. However, changing a culture that encourages gaming of forecasts will probably take time and require incentives to change behaviors. Requiring more detailed sales forecasts is not technically difficult, but it will require sponsorship by senior sales executives and incentives to encourage change. These are changes that any organization seeking to use SF/DP as a way to improve performance must consider.

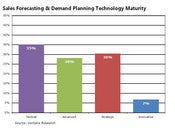

Sales Forecasting & Demand Planning Technology Maturity

(click image for larger view)

Technology. Companies in this research scored highest overall in the Technology dimension of maturity, with a combined 37 percent at the Strategic and Innovative levels, and 35 percent at the lowest Tactical level (see chart at right).

Those at the lowest level of maturity rely heavily on their ERP system and spreadsheets to support the forecasting and planning processes. Spreadsheets are an indispensable tool for individual ad hoc analysis and planning, but they act as a barrier to effective forecasting and planning when used in collaborative, repetitive processes such as enterprise-wide SF/DP. In addition, these companies fail to take advantage of advanced, statistically based forecasting techniques and either wing it or rely on simple extrapolation of past trends. Because they lack the technology, these firms are limited to standard-plan-vs.-actuals reporting, some automated plan publishing and data collection from their ERP or other transaction systems.

Technology is probably the easiest of all dimensions to address in some ways, but that doesn't necessarily make it easy. The decisions (there very likely will be more than one) must be made as part of a master plan, not in isolation; if the decisions aren't made in unison, the value of individual enhancements may be negated by an increase in computing complexity that obstructs progress on the Process and Information fronts. While standardization of computing environments is a worthwhile goal, acquiring subpar tools in the name of commonality is self-defeating. Moreover, since SF/DP initiatives will involve people from many parts of the business, it is important to include each type of user in any software selection process. Failure to consider the requirements of all participants can result in the failure of the project, regardless of a high level of care and effort paid to the other aspects of an SF/DP initiative.

Performance Management. The best-performing companies include performance management in their SF/DP initiatives, according to Ventana. Perhaps the most important element of this is creating performance alignment – that is, linking strategy with corporate goals and objectives in a way that makes best use of the company's resources by coordinating the efforts of every member of the organization.

When SF/DP is part of an overall performance management process, it aligns people, processes and technology and ties operations to objectives. To align people and processes, you must be able to coordinate decisions, at both individual and departmental levels, based on accurate information and clearly understood performance targets. That coordination should enable you to use historical benchmarks, both internal and external, as references for driving organizational change.

While most companies can measure performance, few can apply their systems and processes to manage performance. This is because they have not integrated performance management across manufacturing, operations, sales, marketing and finance departments. One of the first steps in achieving this integration is to include SF/DP as part of your corporate assessments and performance reviews. Supporting performance management requires having an ongoing program to define activities and to link them to objectives. Ventana also recommends that you track the progress of the performance improvement process itself with a report card.

Six Steps to Success

Keeping the four foundational people, process, information and technology components in mind, Ventana suggests that companies seeking improved sales forecasting and demand planning consider the following six-step program:

1. Conduct an SF/DP process and system assessment. The first step is a simple but thorough, independent and unbiased evaluation of your financial and operational performance planning processes and systems. Establish benchmarks for current effectiveness and then identify areas for improvement. Be sure to include calculations for return on investment and total cost of ownership.

2. Identify user requirements and project scope. This step includes defining the business requirements and profiling the business user community. It also involves developing clear definitions of information needs and usage requirements for each person in the performance network.

3. Build a business case to improve value and results. The business case requires definitions of the value as well as specification of the cost of your proposed program.

4. Assemble the program and plan. Once you have executive sponsorship, fill out the details of the program and a plan to communicate it to the various management entities of your organization. You will need to articulate the program differently at different levels and in different areas of the organization so the value is clear to all. Address the cultural, business and technology barriers to ensure that executives will support and follow through on your SF/DP initiative.

5. Evaluate new technology using criteria drawn from the program plan. Establish specific product evaluation criteria appropriate to your organization. Vendors' product capabilities and consolidation in the scorecard and dashboard market have changed the landscape, so you should evaluate all options, from established to new suppliers.

6. Deploy the integrated SF/DP program and set of processes. Plan and work to ensure widespread operational adoption. This requires planning how to minimize disruptions to the business, culture and technology and how to address user resistance.

These steps should lead you to the goal of an organization operating with increased efficiency, effectiveness and operational alignment in the areas of sales forecasting and demand planning.

The Ventana Research report "Sales forecasting and Demand Planning: Setting the Agenda for Improving Core Processes," was written by Robert D. Kugel CFA, senior vice president of research. The report was sponsored by vendors John Galt, Steelwedge Software and True Demand, and by media partners Intelligent Enterprise, Business Manufacturing Technology and Technology Evaluation Centers. The complete report and a related Webinar can be accessed by clicking here (registration required).

About the Author

You May Also Like