Dell Eyes $50 Million Savings On BI, Analytics

Dell standardizes data platforms and business intelligence tools to improve self-service, expand use of predictive analytics.

Sometimes less is more. Dell is counting on this formula in a business intelligence and analytics makeover aimed at reducing spending on redundant technology by consolidating data platforms and standardizing on BI tools while giving business users more options for self-service and deep analytics.

Dell's BI plan was hatched two years ago, long before the $57-billion-plus annual-revenue hardware giant went private. The company assessed its IT and business intelligence capabilities and agility by surveying more than 130 business executives, and it didn't like what it saw. IT was spending some $50 million annually on data warehousing, business intelligence, and analytics. But Dell learned that business units were spending another $70 million, collectively, on independent data-management, BI, and analytics initiatives.

"When we looked at that $70 million BI spend in the business, 70% of it -- or about $50 million -- was spent taking data out of the IT environment and putting it back together in their own databases and customer-support systems," said Rob Schmidt, Dell's executive director for IT, analytics, and business intelligence. "We looked at that and asked, 'how can we reduce that big, $70 million chunk?'"

[Want the latest on BI and big data staffing? Read 2014 US IT Salary Survey: BI & Analytics.]

The answer was to build a developer-friendly architecture around centralized resources including the company's 200-plus-terabyte Teradata enterprise data warehouse (EDW) and centralized SAS analytics environment. The idea was to give the business better access to data, more development and analysis capabilities, and more autonomy on an IT-provisioned, centralized framework.

Work got underway 18 months ago on a three-tier architecture that lets business units (each of which has its own DBAs and BI developers) access data and add and drop tables as it sees fit.

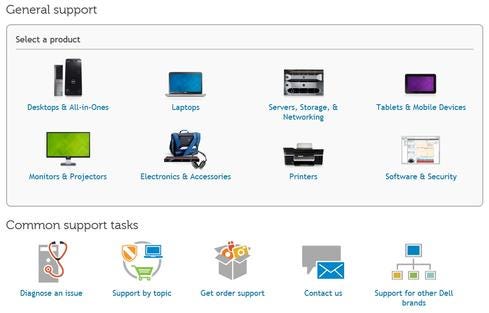

Figure 1:  Machine learning analysis has helped optimize the Dell.com site navigation experience and reduce unnecessary support calls.

Machine learning analysis has helped optimize the Dell.com site navigation experience and reduce unnecessary support calls.

"We're moving to a platform where the business develops its own applications, but they migrate them up into our second tier, where we automate and put processes around the applications," Schmidt explains. "The third tier is our production data warehouse, which the business can't touch."

The technologies in use haven't changed dramatically through the initiative. Teradata and SAS were already in use, as were MicroStrategy and Tableau Software, Dell's standardized choices for production reporting and ad-hoc data exploration, respectively. The real challenge was process change, as business units signing on to take part would no longer be able to extract data and go their own way.

"We're teaching and certifying each business unit to develop against our data platforms," said Schmidt. "And there's a formal agreement between myself and a VP in each business that lays out what you can and can't do on the platform."

"Thou shalt not" rules include limits on extracting data from the data warehouse and writing queries against certain tables that will bring the database to its knees. Schmidt said the certified DBAs and developers within each business unit know he'll "take away access in a heartbeat" if something starts to impact the production environment.

In exchange for giving up their silos, the business units get access to more data and better capabilities than they ever had in their independent reporting and analytical environments, according to Schmidt. New capabilities include a Hadoop cluster for high-scale, low-cost storage and a Teradata Aster

database for rapid analytical modeling against newly available, semi-structured data including social network data, clickstreams from the Dell.com site, and machine sensor data from Dell equipment in the field.

Using these new tools, Schmidt said Dell can support faster, more-frequent, and more-pervasive analysis. For example, a marketing customer-propensity-score analysis that previously required pages of SQL and 16 days of data prep on Teradata takes less than five minutes on Aster, according to Schmidt.

"We used to run customer scoring in batch, and we would update it every two or three months, but now we're doing near-real-time scoring," Schmidt said.

[Want help breaking into this lucrative field? See Big Data Job Hunting: Unconventional Advice.]

Aster is also taking on a complex, high-scale analysis used to spot customers with expiring warranties. That task used to be outsourced to a third-party service company.

"We paid that vendor a significant amount of money, yet we were only able to do the analysis for the Americas," said Schmidt. "With these savings alone we have paid for the new environment and we've rolled [the warranty analysis] out to all of our regions."

Dell has also completed a social media proof-of-concept project whereby social media data captured through the company's (Salesforce.com) Radian6 social media monitoring environment is being centralized and integrated to develop a single view of Dell customers and prospects, tying transactional records with social media handles and email addresses. The effort will reduce the cost of fragmented data-retention and analysis efforts across marketing, sales, and service, Schmidt said.

Figure 2:  Dell is working on a predictive maintenance project whereby sensor data is used to spot hard drives that are headed for failure.

Dell is working on a predictive maintenance project whereby sensor data is used to spot hard drives that are headed for failure.

A next wave of proof-of-concept projects is aimed at improving customer service through analysis of machine data. For example, the customer experience on Dell.com is being optimized by analyzing clickstream data that reveals site navigation patterns and dead ends on the site that turned into service phone calls.

Next up is a predictive maintenance proof-of-concept project aimed at spotting failing hard drives and other equipment before it becomes a problem for customers. This Internet-of-Things-style deployment will tap into sensor data streaming from Dell hardware in use in the field.

The transition to more of a centralized approach hasn't been pain free. In the process of consolidating redundant organizations and maintaining fewer independent databases and software instances, Dell expects to trim staff by more than 1,000 employees. [Editor’s note: After this story was posted, a Dell spokesperson said the company has been able to reallocate staff to work on other projects so that layoffs were unnecessary.] Thus far Dell's marketing, sales, and service organizations are all on board, and Schmidt said he's looking to certify more groups -- and get to that $50 million savings goal -- within the next year.

"We're seeing a massive reduction in data leaving the data warehouse, and we're also seeing a massive increase in the amount of analytics that can be done," Schmidt said. "Because the data is shared across the company, there's very little that I have to do expand this to other groups."

InformationWeek's new Must Reads is a compendium of our best recent coverage of the Internet of Things. Find out the way in which an aging workforce will drive progress on the Internet of Things, why the IoT isn't as scary as some folks seem to think, how connected machines will change the supply chain, and more. (Free registration required.)

About the Author

You May Also Like