Visa Debuts Developer Platform

As digital transactions reshape the payment industry, Visa wants to make sure developers use its technology.

8 iPhone Apps To Help Tackle Super Bowl 50

8 iPhone Apps To Help Tackle Super Bowl 50 (Click image for larger view and slideshow.)

The death of the credit card, long foretold, won't happen because the credit card is more than a transient thing. It's an object, an idea, and a price.

The idea, a trusted way to compete a commercial transaction over distance, remains as vital as ever.

But the two other aspects of credit cards are being reconsidered, and in time, will change. The credit card isn't dying, but it is transforming.

The object, a piece of plastic with a magnetic strip and perhaps a chip, isn't really necessary anymore. It's still useful because it's supported by so much legacy infrastructure and by habit. But it can now take other forms, like an NFC-equipped mobile phone or even a unique code generated from biometric data or cryptographic software.

The price is under pressure as new players and technologies try to make transactions more affordable -- by reducing fees to buyers, sellers, and intermediaries -- and easier to complete.

To avoid being cut out of the payment loop ("disintermediated" in the parlance of Silicon Valley) on Thursday, Feb. 4, Visa launched Visa Developer, a platform that provides software developers with APIs they can use to implement digital payments in their apps. It's not as if Visa is in any immediate danger -- the company processes more than 100 billion transactions annually -- but the investments pouring into digital payment companies and the growing volume of mobile transactions demand a response.

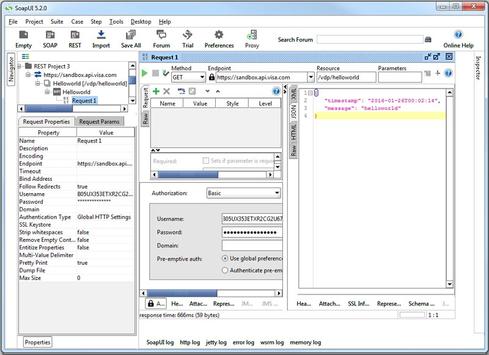

In a blog post, Nitin Chandel, senior vice president of developer platform at Visa, says that the company's platform consists of a Web portal that provides information, infrastructure for testing and analytics, and a set of RESTful APIs for integrating payments into apps.

Ovum senior analyst Gilles Ubaghs, in an emailed statement, said that the arrival of the Visa Developer platform marks a shift in the global payments network and the digital payments space. The capabilities Visa is offering will help the company be seen as a technology company, in addition to a network provider, he said.

Visa's decision to offer a developer platform follows MasterCard's similar move in 2010. It reflects the growing power of developers in selecting the infrastructure through which transactions flow.

"The explosion in growth for payment providers such as Stripe and Braintree has provided a broader shift in thinking in the payments space, with a focus on developer friendly tools, that are flexible and easy to deploy," said Ubaghs. "Whereas traditionally, the choice of payment provider was largely an accounting and finance issue, developers have now come to the fore as key decision makers in payments."

[Read about Apple and Samsung bringing mobile payments to China.]

Visa has invested in Stripe, but Stripe appears to be aiming at a different strata of developers. Where Stripe appeals to individuals and startups for its ease of implementation, Visa's platform demands a bit more work. It requires a merchant account and a payment processor, making it better suited for developers employed by retailers with significant transaction volume or by contract development firms that develop apps for businesses.

Visa's work isn't done. The company is promising more example code, more tools and APIs, and a community forum in the months ahead. But it's a start.

Does your company offer the most rewarding place to work in IT? Do you know of an organization that stands out from the pack when it comes to how IT workers are treated? Make your voice heard. Submit your entry now for InformationWeek's People's Choice Award. Full details and a submission form can be found here.

About the Author(s)

You May Also Like