Walmart Jumps Into Crowded Mobile Payment Market

Walmart Pay debuts this month, joining the already-crowded mobile payment ranks that include Android Pay, Apple Pay, Samsung Pay, and many others.

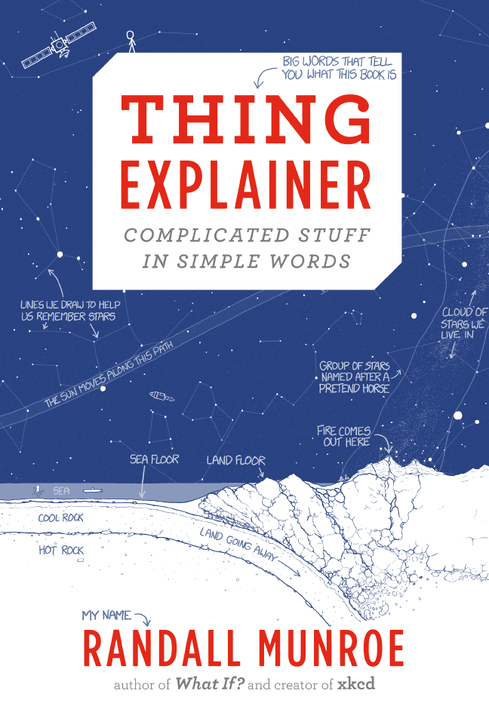

10 Great Tech Gifts For Under $100

10 Great Tech Gifts For Under $100 (Click image for larger view and slideshow.)

On Thursday Walmart said it plans to introduce its own mobile payment system, Walmart Pay, later this month, further complicating the nascent mobile payment market.

The company intends to start accepting Walmart Pay, which will be integrated into Walmart's existing mobile app, in stores near its headquarters in Bentonville, Ark., and then to make the service available early next year at its more than 4,600 stores in the US.

Walmart contends that being able to pay for goods through its mobile app can improve the checkout process. Unlike payment options tried to specific platforms, such as Apple Pay or Samsung Pay, Walmart Pay works on both Android and iOS devices. For the time being, however, Walmart Pay only works in Walmart stores.

Like Android Pay, Walmart Pay aggregates other payment methods. Unlike Android Pay, Walmart's mobile payment system doesn't rely on NFC hardware. Customers simply scan a QR code bill through the Walmart app and Walmart Pay makes the payment through the desired credit, debit, prepaid, or Walmart gift card.

"The Walmart app was built to make shopping faster and easier," said Neil Ashe, president and CEO of Walmart Global eCommerce, in a statement.

Walmart claims 22 million customers per month use the Walmart app, which lets store visitors pick up online orders, refill pharmacy prescriptions, and find an item's location in the store. Some of them will presumably try Walmart Pay. However, that may not be enough to achieve critical mass. In May, Apple had an estimated 38 million Apple Pay-capable iPhone 6 or 6 Plus models in use in the US, according to Consumer Intelligence Research Partners, and its mobile payment system been slow to take off.

When it was introduced last year, Apple Pay was expected to jump-start mobile payments in the US. But its growth has been modest. On a conference call for investors in October, Apple CEO Tim Cook said, "Apple Pay is seeing double-digit growth in transaction month after month …" However, the company has not broken mobile payment revenue out from its "Services" category, which saw 10% year-over-year growth in its fiscal Q4 2015. "Services" includes revenue from Internet Services, AppleCare, Apple Pay, licensing and other services.

Other mobile payment services, notably Google Wallet, have underperformed more dramatically. Google Wallet's travails led to the introduction of Android Pay in September and the repurposing of Google Wallet as a person-to-person cash transfer service.

Yet there's no shortage of competition. Beyond Android Pay, Apple Pay, Samsung Pay, and Walmart Pay, there's also Chase Pay, PayPal, Paydiant, Urban Airship, and Square, to name a few.

[Read Apple Pay, Samsung Pay Push Into More Markets.]

What's more, Walmart is part of the Merchant Customer Exchange (MCX), a group of retailers including Lowe's and Target that also has a payment app, CurrentC, for Android and iOS. It's unclear whether Walmart Pay will dampen the company's desire to participate in MCX.

It is also unclear whether mobile phone users want a payment mechanism beyond their credit and debit cards.

**Elite 100 2016: DEADLINE EXTENDED TO JAN. 18, 2016** There's still time to be a part of the prestigious InformationWeek Elite 100! Submit your company's application by Jan. 18, 2016. You'll find instructions and a submission form here: InformationWeek's Elite 100 2016.

About the Author

You May Also Like