Dog Fitness Tracker Raises $25 Million: Blame Google

As the tech market scrambles for the Next Big Thing, VCs are betting on nervous executives with deep pockets.

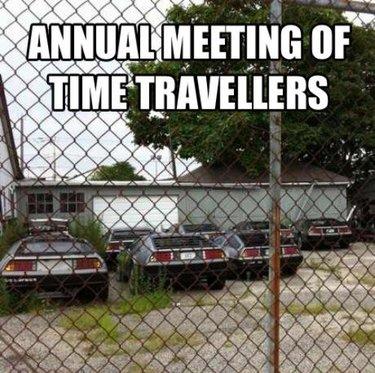

Drones, Phones & More: What Tech Will Last A Century?

Drones, Phones & More: What Tech Will Last A Century? (Click image for larger view and slideshow.)

Forbes reported recently that Whistle, a startup which makes activity trackers for dogs (think FitBit for Fido), raised $15 million in a series B round of venture investment. That $15 million comes on top of a $10 million A round, for a total of $25 million.

How, I thought, could sharp-eyed investors expect to get any kind of return on a product that is patently useless? Do these investors really think there are hundreds of thousands of people stupid enough to drop $100 on a dog fitness tracker?

And then I got it. The investors aren’t betting on the stupidity of large numbers of Americans. They’re betting on the fear and anxiety of a small number of CEOs and corporate board members.

Big tech companies watch as Apple rakes in obscene amounts of money every quarter from its phone and tablet sales. Given that these two markets are essentially locked up, companies that aren’t Apple are desperately scanning the horizon for the Next Big Thing — a new gadget that captures hearts and wallets by the billions.

What is the Next Big Thing? We don’t know. No one knows. It could be pet wearables. Or exploding kittens.

[ Whistle isn't the only company making a play for pet wearables. Read 7 Cool Wearables For Pets. ]

What we do know is that it’s out there—somewhere. We also know that when it appears, it’s going to seem like a perfectly obvious idea, and it’s going to make someone an obscene amount of money.

So companies are making bets, and one area where they’re betting big is the Internet of Things, or IoT. I blame Google for this.

When the search giant spent $3.2 billion on Nest, a thermostat and smoke detector company, it was a signal to the venture community. The signal said, “We don’t want to miss the next Golden Ticket, so we’ll throw gobs of money at things that have sensors and an app.”

Thus, VCs, can risk floating a few tens of millions to startups hawking ridiculous IoT products. The startups don’t need a sensible business plan. They don’t need to capture a large market share. They don’t need to create a viable business.

That’s because VCs aren’t worried about selling this stuff to consumers. That’s not who the VCs are targeting. They’re targeting anxious CEOs and sweaty board members at big tech companies who are panicked about getting disrupted or missing the next boat.

That’s a much easier sell. And the VCs don’t need a billion-dollar exit to make a tidy profit. A few hundred million from a tech company hedging its bets will do just nicely. Woof.

Attend Interop Las Vegas, the leading independent technology conference and expo series designed to inspire, inform, and connect the world's IT community. In 2015, look for all new programs, networking opportunities, and classes that will help you set your organization’s IT action plan. It happens April 27 to May 1. Register with Discount Code MPOIWK for $200 off Total Access & Conference Passes.

About the Author(s)

You May Also Like

How to Amplify DevOps with DevSecOps

May 22, 2024Generative AI: Use Cases and Risks in 2024

May 29, 2024Smart Service Management

June 4, 2024