Tablet Sales Slow Down; Microsoft Struggles

Tablets are losing some of their luster, but Apple is still selling more devices than Microsoft.

Apple's Next iPads: 13 Things To Expect

Apple's Next iPads: 13 Things To Expect (Click image for larger view and slideshow.)

With Apple expected to announce new iPads this Thursday, many analysts have questioned whether the new devices will revitalize slowing tablet sales. Research firm Gartner added more fuel to the fire this week, announcing new data that shows tablet shipments have continued to decelerate.

Gartner's report reinforces questions about iPads' growth prospects, but the data's most troubling implications were reserved for Microsoft. Analysts expressed doubt that Windows Phone will become a significant smartphone player and forecast that most Windows growth will occur among low-cost devices in emerging markets.

Gartner expects worldwide tablet shipments to reach 229 million units this year, an 11% increase compared with 2013. But tablet shipments exploded 55% in 2013, which shows how quickly the industry's growth has slowed.

[Will device freedom while flying be short-lived? Read Flight Attendants Want Mobile Device Ban Reinstated.]

Several factors have contributed to the tablet slowdown. In a statement, Gartner research director Ranjit Atwal noted that tablet owners are waiting longer than expected to replace their devices. Many consumers buy new smartphones every couple of years, both because two-year carrier plans encourage regular upgrades, and because users carry smartphones at all times, which means new improvements are often more deeply felt. But tablets play a more specialized role in most users' routines, and many tablet owners have shown they'll go more than three years before upgrading.

Additionally, Atwal said some tablet users "are not replacing a tablet with a tablet." He noted increased sales of two-in-one devices such as Microsoft's Surface Pro 3. Earlier this month, both Gartner and fellow research firm IDC released data that indicates PC sales, which had been in freefall the last few years, have begun to stabilize. Some of the improvement owes to new device types, as Atwal noted, but some also involves Microsoft's end-of-service deadline for Windows XP, a move that forced millions of customers to buy new computers.

Figure 1:  After exploding out of the gate, iPads sales have begun to slow.

After exploding out of the gate, iPads sales have begun to slow.

Gartner said tablet shipments are still on track to exceed shipments of desktop and notebook PCs by 2015. The firm projects OEMs will ship over 276 million traditional PCs this year, down from over 296 million last year. Tablet shipments are expected to hit 229 million. For 2015, Gartner expects desktop and laptop PC shipments to drop to 261 million units, with tablets swelling to around 273 million.

That said, Gartner expects "premium ultramobiles" -- a category that includes two-in-one hybrid PCs -- to grow as sales of traditional PCs decline. In addition to the 276 million desktop and laptop shipments Gartner expects this year, the firm also anticipates shipments of 37.6 million high-end ultramobiles. Analysts expect this category to amass more than 64 million shipments in 2015.

"The device market continues to evolve, with the relationship between traditional PCs, different form factor ultramobiles (clamshells, hybrids and tablets) and mobile phones becoming increasingly complex," Atwal noted.

Other recent data indicates two-in-one devices have carved out a niche in North America but are still outsold by not only iPads but also Apple's

Mac computers. The upcoming slate of ultra-slim hybrid devices with next-gen Intel processors could have more mass market appeal, however.

Outside of tablets and PCs, Gartner expects smartphone growth to continue, with shipments set to hit nearly 2 billion units in 2015. Analysts don't expect this growth to allow more OS players to enter the industry, however. With Android dominating overall market share and Apple solidifying its hold over the high-end market, Gartner concluded it remains "difficult for alternative ecosystems to become more than niche players."

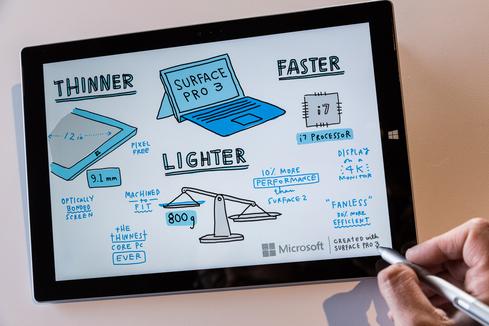

Figure 2:  Two-in-one devices such as the Surface Pro 3 have injected some life into the Windows market, but Microsoft's mobile growth continues to trail the competition.

Two-in-one devices such as the Surface Pro 3 have injected some life into the Windows market, but Microsoft's mobile growth continues to trail the competition.

This complexity is reflected in Gartner's projections for the three major computing platforms: Windows, Android, and iOS/Mac. Although there are clear limitations to lumping desktop PCs and smartphones into a single ecosystem category, the shift toward mobile devices has reshuffled which apps and services carry the most cultural and economic sway. Gartner expects Windows to remain the dominant PC OS, but with PCs becoming just one component in multi-device use cases, Microsoft could face challenges if its mobile platforms don't pick up steam.

Earlier this year, Microsoft execs admitted that Windows runs on only 14% of devices overall and pledged to gain more users. The company is currently hedging its bets between the Windows ecosystems and an increasingly cross-platform software strategy.

In mature markets -- where users tend to buy higher-margin devices and invest more in accessories, apps, and services -- Gartner found that Android is the leading OS overall, with over 313 million device shipments projected this year. Apple's ecosystem is expected to finish a distant second in 2014, with nearly 168 million iPhone, iPad, and Mac shipments. Windows shipments are expected to hit 141 million units in 2014.

In 2015, Gartner expects the same pecking order though it projects Apple will gain ground while Windows falls farther behind. The firm estimates device shipments within Apple's ecosystem will expand nearly 9% next year in mature regions, followed by Android with 7.7% growth, and Windows with around 5%.

In developing markets, Android will amass more than 900 million device shipments this year, and over 1.1 billion in 2015, according to Gartner's data. Windows still outpaces Apple's platforms in these regions, with an estimated 194 million this year and another 221.8 million projected for 2015. Macs and iOS devices are expected to account for around 95 million shipments this year in developing regions and more than 112.6 million next year.

As was the case with mature territories, Gartner expects Windows to post the slowest growth in emerging markets, with 14.3% ecosystem growth anticipated for 2015. Gartner expects shipments of Apple devices to grow 18.2% and shipments of Android devices to grow more than 20% next year.

The Internet of Things demands reliable connectivity, but standards remain up in the air. Here's how to kick your IoT strategy into high gear. Get the new IoT Goes Mobile issue of InformationWeek Tech Digest today. (Free registration required.)

About the Author

You May Also Like