Digital War Chest: Crypto and Russia’s Invasion of Ukraine

Digital currency becomes a key component in a real-world conflict where all avenues of defense and support are explored.

As the grim reality of Russia’s armed invasion of Ukraine continues, moves are being made on either side of the conflict to secure access to monetary resources via digital means. Traditional banking and other financial transactions are seeing disruptions in the form of sanctions leveled against Russia and the basic fact that a war is underway. Cryptocurrency and other digital mediums are being used to provide alternate financial access that might support affected economies that otherwise might be cut off from the rest of the world.

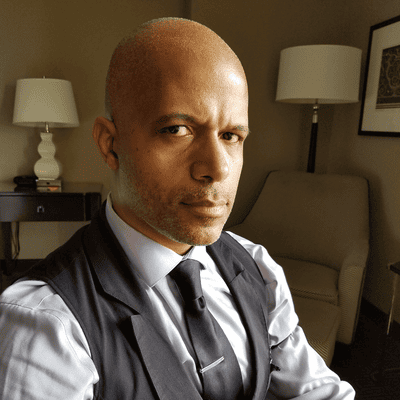

A conversation with Rance Masheck, president and founder of next-gen trading platform iVest+, helped shed some light on the role crypto plays in the financial logistics behind the scenes of the armed conflict and what this might say about digital currency farther in the future.

Condemnation of Russia’s attack brought a call to sever the country from SWIFT (Society for Worldwide Interbank Financial Telecommunication), a global provider of secure financial messaging services. SWIFT, based in Belgium and run by a cooperative, is used by financial institutions around the world to exchange information for the execution of payments and other transactions. The system handles more than five billion messages each year and plays a significant role in clearing transactions between banks and is significant to international commerce.

Cutting Russia off from SWIFT to erode its economic footing was part of an effort to isolate and pressure the country to cease hostilities. In the digital era of fintech, businesses and other institutions within Russia might explore alternatives to circumvent the ouster from SWIFT. “It is very evident that there will be ways to get around some of the issues caused by being blocked from SWIFT by using cryptocurrency,” Masheck says.

Russia Not on Sanction List for Bitcoin -- Yet

At the time of this writing, Russia was not on the sanction list for Bitcoin, which he says does not make it illegal to conduct transactions in the country -- yet. “It’s just that the conduit for the transaction, SWIFT, is not available,” Masheck says, which has led some companies to make payments there via Bitcoin instead.

Another alternative, the Cross-Border Interbank Payment System (CIPS) run by a cooperative in China, is also being offered up to Russia as way to bypass SWIFT.

On the other side of the conflict, digital finance is being tapped by some who want to support Ukraine’s people and continued defense against such boldfaced aggression. For example, cryptocurrency donations totaling in excess of $35 million have been reported to be going to Ukraine in this time of need.

Plenty has been said about Bitcoin and its digital ilk over the years, but current events have brought increased attention and interest to cryptocurrency. Masheck says his company tracks the number of large transactions that take place and in recent days, Bitcoin saw more than $200 billion-worth of transactions that each were in excess of $100,000. The geography of where those transactions were conducted paint a picture of crypto being used to cope with a rapidly changing situation. “The run on the banks that are going on right now in Russia, you’re going to see some of that moving into crypto for safety,” he says.

While the Russian ruble plummeted 20-25% in value, crypto may be seen as a flight to sanctuary for some, Masheck says. Businesses are already turning to cryptocurrency, he says, to conduct transactions. “Crypto allows large blocks of money to be moved around without going through traditional means, which could buffer some of the impact of sanctions in Russia.”

Crypto Stress Test

The varied ways crypto is being put to work in the shadow of the conflict may accelerate its maturation as a form of currency. “It’s a stress test,” Masheck says. “There’s already been issues with hacking in crypto. This is going to be a real test to see if this holds up.”

As often happens in times of crises, pressure forces innovation to grow up fast to help address immediate needs. This is somewhat comparable to the increased digital transformation, cloud migration, and remote work that occurred at the height of the pandemic. Just as that shift revealed the potential for exposure to bad actors, higher volume use of crypto may escalate risks associated with it, especially in the context of an armed, international conflict. “There’s a cyber warfare part of this that’s going to be taking place,” Masheck says. “How much of that is going to be directed at crypto -- who knows?”

That is just part of the heavy lifting that may yet come as cryptocurrency gets leveraged in this crisis, which has very tangible individual and international consequences. Despite the heightened attention, Masheck says crypto does not currently offer the speed of clearing transactions that SWIFT does, making it far from a simple solution to banking and commerce issues during war. “The period of time it takes to validate and the mining that has to happen, it’s not going to be as quick,” he says. “Is it going to be as secure? That’s part of the test we’ll see.”

Related Content:

Facing Decentralized Finance and Crypto Security Dilemmas

About the Author

You May Also Like