Pricewaterhouse Coopers Forecasts Top Health IT Trends

Analyst firm predicts that the industry will undergo an extreme strategy makeover in 2011, due to federal mandates, continuing cost pressures, and consumer demands.

17 Leading EHR Vendors

(click image for larger view)

Slideshow: 17 Leading EHR Vendors

While 2011 promises to be a year of increased health IT spending, a report from PricewaterhouseCoopers (PwC) shows that 86% of consumers do not access their medical records electronically and, of the 14% who said they can, 40% to 50% can't access information such as lab tests or physician visit notes.

This may change in 2011 when health organizations undergo a strategy makeover as they react to new rules and payment models, continuing cost pressures, and customer demands, according to the Top Health Industry Issues of 2011, published Monday by PwC's Health Research Institute.

However, the report, based on an online survey of 1,000 adults, found that consumers don't fully understand or buy in to all the changes. As the American healthcare system continues to adopt health IT, which PwC says will accelerate in 2011, the report revealed that less than half of consumers know what a health insurance exchange is; nearly three-fourths would trade employer-sponsored insurance for higher pay; and more than a third believe costs and waiting times will increase as a result of healthcare mergers.

PwC also found that consumers seek health information from media companies more than from government, healthcare companies, and consumer companies combined, and only half of consumers said they would stay within a structure like an accountable care organization (ACO), which manages the continuum of patient care and rewards healthcare providers for effective and efficient care, for all of their care.

"Health organizations are engaged in a lot of activity, but the success of their efforts ultimately depends on the engagement of consumers -- who are at the center of many of the policy goals for health reform," Daniel Garrett, principal of PwC's health information technology (HIT) practice, said in a statement.

While the hope is that consumers will continue to learn more about new models of care in the coming year, IT executives at hospitals and physician offices will be working feverishly to implement electronic health records (EHRs) to meet Stage 1 Meaningful Use criteria, which is a prerequisite to quality for federal stimulus funds in 2011.

Next year health IT executives will also face other tasks that include working with multiple players to establish new population management models like ACOs, using technology to drive down costs in pharma/life sciences companies, and bringing onboard more skilled resourced to coordinate the building of a new technological infrastructure.

"The pressure is on healthcare executives, especially chief information officers, who face new risks, knowing that new care delivery models, payment bonuses, and quality measurements are dependent on their designing an IT structure that can support the information exchange. For providers, the year will go better if they fit together all of the compliance efforts around EHRs, ICD-10 coding preparation, and HIPAA 5010 transactions to improve care and meet patient demands," the report said.

Health IT Boosts Patient Care, Safety

(click image for larger view)

Slideshow: Health IT Boosts Patient Care, Safety

Each year, PwC's Health Research Institute identifies the issues that it believes will influence the health industry agenda in the year ahead. For 2011, the top six issues are:

1. Record spending on HIT in 2011 is likely to increase demand for skilled HIT professionals, an expanded role for CIOs, and increased merger and acquisition activity among organizations looking to share the cost and benefits of HIT integration.

2. Significant changes in benefit plan design, plan pricing, and the health plan landscape can be expected as insurers adapt to a new medical loss ratio. Despite of the ruling this month on the constitutionality of the individual health insurance mandate, states will have to continue moving forward on developing health insurance exchanges (HIEs).

3. New risks and opportunities may emerge as payment models shift from fee-for-service to new models that focus on performance, health outcomes, and shared cost savings in ACOs.

4. Health organizations may feel the trickle-down effect of decreased utilization by price sensitive consumers.

5. A further uptick in merger and acquisition activity is one way health organizations may share administrative burdens and IT investments, gain market share, and fill strategic gaps.

6. Pharmaceutical companies see an opportunity to increase their visibility with consumers, influence health outcomes, and reduce healthcare costs while increasing revenue using digital strategies and technology. The use of mobile health and wireless technologies by all health organizations is expected to continue to surge.

Taking A Deeper Look At The Issues

Following is a more in-depth look of PwC's top issues for health industry organizations in 2011:

Booming HIT Business

The HIT spending boom is driven by: (1) federal requirements that hospitals and physicians meet at least Stage 1 requirements for the Meaningful Use of EHRs to qualify for federal stimulus funds in 2011; (2) an aggressive timetable for massive back-office infrastructure upgrades to comply with new medical coding requirements that will add five times the number of diagnostic and inpatient codes and compel providers and payers to use the new HIPAA 5010 electronic transaction format, which will require more than 1,300 system modifications by January 2012; (3) final FDA rules that will mandate online reporting of adverse events related to medical devices, resulting in possible new tracking technology throughout the supply chain.

Stage 1 Meaningful Use requires hospitals and physicians to provide patients with an electronic copy of their health record upon request. But consumers are not asking. Nearly half of consumers (49%) surveyed still call their doctor's office to request paper medical records. While the EHR policy goal is to help consumers participate in shared medical decision-making, only 13% of consumers have ever been asked for input into what they would like to see in their EMRs or how they would like to use them.

Healthcare Innovators

Slideshow: Healthcare Innovators (click image for larger view and for full slideshow)

Redefining Health Insurance

The health reform law now requires health plans to spend a minimum of 80 to 85 cents of every premium dollar on medical care and healthcare quality improvements, depending on the size of the plan. If health plans spend less than the minimum threshold, they must give customers a rebate beginning in 2012.

According to PwC, this will require an unprecedented level of actuarial precision for rate-setting, and insurers may opt to pay rebates rather than under-price their products in the first year. Many insurers already are contemplating new pricing and rebate scenarios for group plans.

At the same time, many businesses are weighing the advantages of employer-sponsored health coverage as HIEs come online. PwC anticipates a high level of state legislative activity as employers, health plans, and states begin to work together in 2011 to define and develop HIEs.

Rise Of Accountable Care Organizations

ACOs have created "next big thing" buzz in the healthcare management industry. But 2011 could be a make-it-or-break-it year for ACOs depending on Congressional action. In anticipation of new performance payment incentives, health organizations are positioning themselves to participate in ACOs and share risks and rewards of keeping people healthier.

While ACOs hold great promise for reduced costs and improved quality, the challenge will be keeping people in the ACO and engaging them to stay healthy, which could be the difference between profit and losses. PwC's research found significant demographic and geographic differences in consumers' willingness to seek all their care within ACO-like organizations, indicating the need for consumer segmentation strategies.

Consumers May Restrict Utilization

Higher health insurance premiums, steeper deductibles, and larger coinsurance mean consumers are spending more out of their own pockets for healthcare, and 60% of consumers surveyed by PwC expect to pay even more in the future. Yet cost shifting may have reached the end of the line, as increased price sensitivity has caused consumers to decrease utilization.

PwC forecasts a trickle-down effect, starting with physicians and pharmaceutical companies, as consumers minimize office visits and drug spending, followed by reduced sales of other medical products and fewer lab tests, imaging scans, and other diagnostics. The danger lies in whether short-term cost avoidance could lead to more expensive conditions long term.

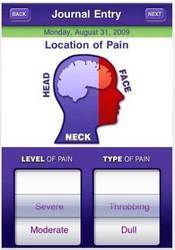

15 Healthy Mobile Apps

(click image for larger view)

Slideshow: 15 Healthy Mobile Apps

Mergers & Acquisitions To Fill Gaps

M&A activity among all the healthcare sectors is expected to continue to trend upward in 2011. Within the pharmaceutical and life sciences sectors, PwC expects deals to focus on strategic mid-market transactions valued between $100 million and $500 million; international growth could yield larger transactions.

Increased consolidation is expected among payers, physicians aligning with hospitals, and hospitals merging with other hospitals and health systems, and recent deals reflect blurring of the lines between payers and providers.

Competition for acquisitions is likely to come from private equity funds investing in healthcare. Though consumers are wary of the benefits of M&A, many seem open to new provider alliances. Seventy-eight percent of consumers said they would rather use a retail clinic partnered with a local hospital for primary care services, versus only 22% who would prefer an independent company.

Consumer Demand For 'Always On' Healthcare

The mobile health market is growing exponentially as health organizations use wireless and remote technology to interact with patients anytime, anywhere. To influence patient outcomes, organizations have to engage patients and understand how to connect with them.

Healthcare organizations are spending significant resources to produce online content, yet PwC found that consumers are 3.5 times more likely to go to the media and third-party information service companies for information about treatments and conditions, than to any other site, especially pharmaceutical company Web sites.

Only 11% of the people PwC surveyed said they would go to a pharmaceutical company for health information. Pharmaceutical companies have typically been removed from their product end users, but by understanding online preferences and adopting multi-channel strategies to meet consumers on their terms, pharmaceutical companies see an opportunity to significantly increase their visibility.

About the Author(s)

You May Also Like