What Midmarket CIOs Care About Most

Business analytics and self service, according to the newly released midmarket portion of IBM's 2009 Global Chief Information Office Study, but CIOs of high growth companies have different priorities than those at slower growing organizations. Finally, no matter what size firm they represent, CIOs face a similar set of conflicting goals and contradictory roles.

Business analytics and self service, according to the newly released midmarket portion of IBM's 2009 Global Chief Information Office Study, but CIOs of high growth companies have different priorities than those at slower growing organizations. Finally, no matter what size firm they represent, CIOs face a similar set of conflicting goals and contradictory roles.While the study covered over 2,500 CIOs overall, IBM has just released a Midmarket Executive Summary detailing the views of 158 CIOs of companies with fewer than 1,000 employees. As usual, bMighty is intensely interested in how midmarket CIOs differ from their enterprise counterparts.

In fact, last month we offered a sneak peek at the midmarket results when IBM released Cognos Express business intelligence product for the midsize companies. But now Big Blue has come up with a much more comprehensive Executive Summary of the midmarket CIO.

Don't Miss: IBM's Cognos Express Brings BI To The Midmarket

The newly released data separates CIOs into high-growth and low-growth categories, based on relative growth in profit before tax (PBT) from 2004-2007, and finds some significant differences between the groups.

For example, more than half of the high-growth group gets involved in creating business strategy, compared to just 33% of enterprise CIOs.

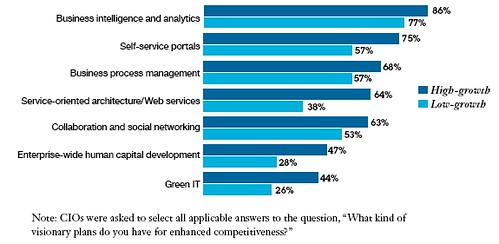

86% of CIOs at "high growth" midmarket companies named business intelligence and analytics as the top technology for enhancing competitiveness over the next 5 years. (77% of low-growth CIOs shared that perception.)

75% of high-growth CIOs said self-service portals were the most important technology (versus 57% of low-growth CIOs).

High-growth midmarket CIOs spend almost 2/3 of their time on innovation-related activities, including generating buy-in for innovative plans, implementing new technologies and managing non-technology business issues.

88% of high-growth midmarket CIOs plan to use new marketing and customers service channels in the five years, compared to 72% of low-growth midmarket CIOs.

80% of the high-growth group plan to improve their companies' integration and transparency, versus 45% of low-growth CIOs.

Other areas where the high and low growth groups diverged included Human capital development (47% to 28%) and Green IT (44% to 26%), although the overall numbers for both groups were much lower on these factors.

High growth or low-growth, the study also shared some concerns facing midmarket CIOs as a group:

50% of midmarket CIOS expect to implement a virtual infrastructure in the next five years.

55% of midmarket CIOs anticipate changing their business models within 3 years.

In some important ways, though, midmarket CIOs face the same issues as enterprise IT leaders. According to the IBM study, all CIOs today find themselves forced to juggle opposing roles:

Visionary vs. Pragmatist

Value Creator vs. Cost Cutter

Business Leader vs. IT Manager

Success, the study claims, lies not in favoring one side over the other, but in finding ways to reconcile all of these conflicting priorities.

Hey, we knew being a midmarket CIO wasn't easy... Download The IBM Study: Midsize Organization Executive Summary

Follow Fredric Paul on Twitter @ http://twitter.com/TheFreditor Follow bMighty.com on Twitter @ http://twitter.com/bMighty Put a bMighty gadget on your iGoogle page Get bMighty on your mobile device

About the Author

You May Also Like