Automated Accounts Payable Gives Biotech Company New Efficiency

Adopting a system from Tipalti freed up manhours and other resources as biotech company ImaginAb scaled up and adapted to pandemic woes.

Biotech company ImaginAb -- which develops next-generation cancer-fighting technology -- says it cut down some 1,750 manhours when the company adopted automated accounts payable software from Tipalti. Operating on the global level, ImaginAb must contend with multi-currency accounts payables. The company previously maintained a full-time finance manager who focused on paying invoices, but ImaginAb sought to streamline its approach to the complex task.

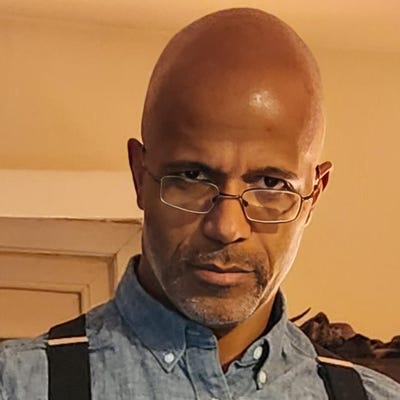

David Fractor, CFO at ImaginAb, says the combination of working remotely in response to the pandemic and the potential to be more efficient led to adopting Tipalti’s system. The accounts payable function at ImaginAb evolved, he says, as the company grew and saw a ramp-up in invoices. Initially, ImaginAb’s finance manager worked with an escalating amount of paperwork and checks that needed to be signed. “We’re making FedEx a lot of money as we send these packages back and forth across the country,” Fractor says.

Prior to using Tipalti, ImaginAb saw about 15 invoices per week handled by one person, he says. The old method of approving and signing invoices became a hassle. “The tracking and managing of all that was a problem.” He says Tipalti’s system cuts down time by issuing reminders to read and approve invoices.

“We’re probably doing about 45 invoices a week now.” Accounts payable duties are now overseen on a part-time basis by an accounting manager, he says.

Even prior to the pandemic, Jill Durkin, controller for ImaginAb, saw a need to change how accounts payable was handled as the volume of work grew. Changes driven by the outbreak of COVID-19 accelerated those considerations. “The pandemic forced senior management to look at the processes -- especially when we all fled to our home sites,” she says. Durkin had looked at a variety of payable systems at a conference the year prior and the next time she visited the conference, she says was on a mission to explore as many options as possible, then narrowed those down to three choices. “I definitely wanted AI technology for reading invoices to limit the time spent coding invoices,” Durkin says. “My second criterion was global payments.”

She says she recommended Tipalti to her company’s management because of the system’s ability to handle global payments. This became increasingly important as ImaginAb’s reach expanded with clinical trials conducted on other continents and the need to set up wires separately for each vendor. “We were paying a wire fee for every vendor,” Durkin says. “We were paying a foreign transaction fee for every vendor.”

There was also a desire to cut back on the physical clutter that paperwork generates. “Everything was paper,” Durkin says. “You printed an e-mail that showed the invoice was approved. You stapled a check to the original invoice. It was just piles of paper being pushed around and then stacked on someone’s desk.”

The automated system alleviated such burdens, she says. “The workflow is all digital.” Durkin also says the system can accommodate ImaginAb scaling up further in the future. “We could probably double or triple where we’re at again and still not have to hire another person,” she says.

Durkin says the use of the automated system has let others on staff focus their energies elsewhere. “I no longer have to do tedious accounts payable paperwork,” she says. “I can actually elevate and do some fundraising activities, things that are more CMO-level. Automation frees up your time to work on more important initiatives.”

Having put Tipalti’s system to work, Durkin says she wants to look at additional digital resources for expense control as well as ways to further streamline ImaginAb’s processes. “Now that we’re completely digital, what systems that are digital are cumbersome to the month-end close for getting financial reporting done?” she asks. “What are our roadblocks?”

Read more about:

2022About the Author

You May Also Like